- Home

- Horizons

- The Development of Global Finance Under High Tariff Pressures and China’s Path to Becoming a Financial Power

Liu Ying is a Research Fellow at Chongyang Institute for Financial Studies, Renmin University of China.

Liu Ying is a Research Fellow at Chongyang Institute for Financial Studies, Renmin University of China.

In less than 100 days since the new U.S. President took office, a sweeping 10 percent base tariff has been imposed globally, with additional tariffs ranging from 10 percent to 245 percent targeting China and dozens of other nations. These high tariffs have severely impacted global financial markets, triggering extreme volatility, particularly in the United States, where the Nasdaq index plunged by as much as 6,903 points from its recent peak by April 21st, entering a technical bear market. Markets in Europe and the Asia-Pacific, including Japan and South Korea, also experienced turbulence, with some exchanges triggering circuit breakers. As the world’s second-largest financial market, China has likewise been affected to varying degrees. In this context, China’s financial sector has contributed a measure of certainty and stability to global finance. In particular, China’s ambition to become a financial powerhouse is driving its financial sector to develop key areas, including technological, inclusive, green, digital, and elderly-care finance. From the impact of tariff wars on global financial development to emerging trends, China is injecting vitality and new opportunities into the world’s financial system.

Global Financial Development and China’s Financial Power Strategy

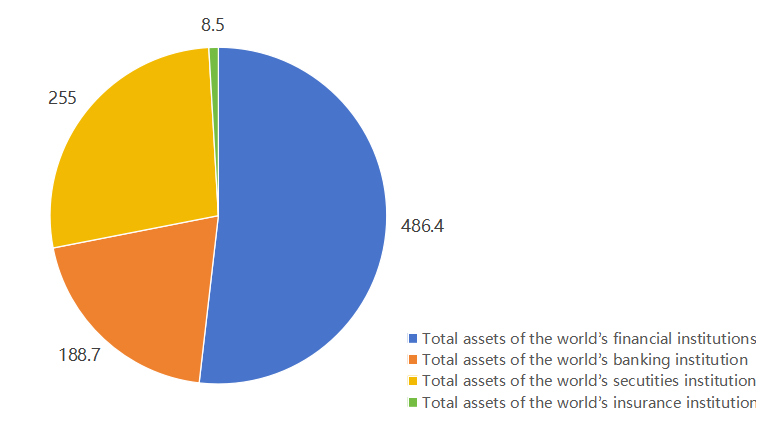

As of the end of 2024, global financial assets totaled $486.4 trillion, including $188.7 trillion in banking assets, $255 trillion in bond market assets, and $8.5 trillion in insurance assets.

1. Banking Assets in Major Economies Continue Expanding

In recent years, central banks in the United States, Japan, and the Eurozone have transitioned from zero or negative interest rates and quantitative easing to rate hikes, and more recently, have reverted to cutting rates again. This has resulted in an overall expansionary trend in the global financial sector, accompanied by increased money supply, swelling balance sheets (notably the Fed’s), and rising capital markets.

Under the Trump Administration, financial deregulation accelerated, and digital currency gained policy support. From the Fed’s 2020 QE measures to 11 interest rate hikes between 2022 and 2023—bringing rates to 5.25 percent-5.5 percent—U.S. banking grew in line with this expansion. By the end of 2024, total U.S. banking assets reached $24.1 trillion, up 1.8 percent year-on-year. Despite high tariffs pushing inflation expectations higher and the Fed pausing rate cuts, the banking sector’s growth momentum remained somewhat intact.

Eurozone banking assets totaled $29.1 trillion, marking a 2.7 percent year-on-year increase. As inflation fell to 2 percent, the region experienced a mild recovery, though the unresolved Russia-Ukraine conflict continued to limit credit demand. Some major institutions reported significant credit contraction. Meanwhile, asset expansion reflected increased sovereign debt investment amid rate cuts. UK banking assets rose to $8 trillion, an increase of 2 percent.

In the Asia-Pacific, Japan’s top three financial groups held $6.4 trillion in assets, up 5.8 percent. Among emerging economies, Brazil’s banking assets rose 13 percent, Indonesia’s 7 percent, and Malaysia’s 1.6 percent.

2. Rising Profitability Alongside Asset Growth

In 2024, varying economic recoveries and the impact of high interest rates led to divergent banking profits. U.S. banks posted $268.2 billion in net profits (up 5.6 percent), driven by non-interest income. However, 6.7 percent of banks reported losses, with community banks seeing profits decline by 2.4 percent.

The Eurozone, hit hard by the prolonged Russia-Ukraine war, saw net profits fall 9.2 percent to $175.1 billion. UK banks earned $43.71 billion (down 4.2 percent), with net interest income falling by 4.4 percent.

In the Asia-Pacific region, profits generally increased due to overseas expansion and stronger domestic markets. Japan’s top banks earned $25.79 billion, up 30 percent, largely from overseas gains. Malaysia and Indonesia each recorded 9.4 percent profit growth. Brazil posted $29.96 billion in net profits, up 17.1 percent.

Despite profitability, NPL ratios also rose. U.S. bad loans reached $124.97 billion, up 16.7 percent, with a 0.99 percent NPL ratio. Eurozone and UK NPL ratios rose to 2.13 percent and 2.05 percent, respectively. Japan’s ratio dropped to 1.2 percent. Emerging economies showed stronger asset quality, with Brazil, Malaysia, and Indonesia improving their NPL ratios by 0.55, 0.16, and 0.23 percentage points, respectively.

Capital adequacy ratios improved across the board. U.S. banks reached 15.71 percent, the Eurozone 19.5 percent, and Japan 17.05 percent. Emerging economies also saw capital strength improve, with Malaysia, Indonesia, and Thailand increasing their ratios by 0.05, 1.15, and 0.56 percentage points, respectively.

3. China’s Steady Banking Asset Growth

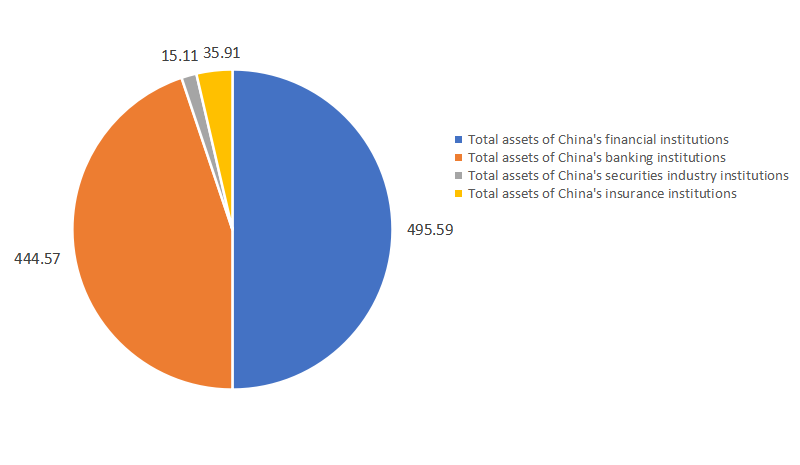

In line with its strategy to become a financial power, China’s financial industry continued its steady growth. By the end of 2024, total financial institution assets reached RMB 495.59 trillion (up 7.5 percent year-on-year). Banking assets hit RMB 444.57 trillion (up 6.5 percent), securities RMB 15.11 trillion (up 9.1 percent), and insurance RMB 35.91 trillion (up 19.9 percent).

4. U.S. Deregulation Brings Opportunities and Risks

The Trump Administration’s deregulatory stance created both opportunities and risks. Liquidity expansion and eased regulations supported credit growth and softened the impact of low interest rates. Financial deregulation, especially the rollback of Dodd-Frank, boosted short-term profits but increased systemic risk.

The U.S. withdrawal from the Paris Climate Accords reduced green transition costs for banks. HSBC followed U.S. peers in delaying net-zero targets. British and Japanese banks expanded in Southeast Asia. While emerging Asia remained stable, Brazilian banks could face pressure.

High Tariffs Shake Global Markets and Drive Monetary Divergence

U.S. tariff volatility has driven investors away from U.S. assets, shifting the “Trump trade” into the “Trump recession.” Stock, bond, and currency markets fell simultaneously, while gold surpassed $3,400/oz as a safe haven.

The March CPI fell to 2.4 percent, allowing for Fed rate cuts, but high tariffs cast a shadow over inflation, with many forecasting an additional 2 percent CPI increase. Recession risks rose sharply.

-

Tariff Impact on Capital Markets

Markets initially expected Trump to fight inflation, but erratic tariff policies reversed sentiment. By April 21st, 2025, the Dow had fallen 6,903 points (15.3 percent), the Nasdaq had plunged 4,303 points (21.3 percent), and the S&P 500 had dropped 986 points (16 percent), marking a technical bear market.

-

Monetary Policy Divergence Intensifies

Though inflation expectations rose, the Fed paused after three 100-bps cuts in 2024. Despite pressure from Trump, Chair Powell held firm. The ECB had cut rates seven times by April 2025. China had already entered a loosening cycle in 2021. Japan hiked rates to 0.5 percent, its highest level in 17 years.

Most central banks eased rates, including Turkey (down 500 bps), Mexico (down 50 bps), and India (down 25 bps). Brazil bucked the trend, hiking 200 bps to combat inflation.

The Fed’s inaction, with rates still at 4.25-4.50 percent, has exposed U.S. banks to CRE default risks. The 2025 failure of Pulaski Savings Bank revived fears from the earlier collapses of SVB, Signature, First Republic, and Credit Suisse.

China’s Financial Power Strategy Elevates Scale and Quality

1. Steady Growth in the Asset Scale of China’s Banking Sector

Under its strategy of building a strong financial nation, China’s financial industry has also seen steady growth. In both banking credit and capital market size, China ranks among the top three globally. As of the end of 2024, the total assets of China’s financial institutions reached RMB 495.59 trillion, representing a year-on-year increase of 7.5 percent. Of this, banking institutions held RMB 444.57 trillion in assets, up by 6.5 percent; securities institutions accounted for RMB 15.11 trillion, an increase of 9.1 percent; and insurance institutions reached RMB 35.91 trillion, up by 19.9 percent. Meanwhile, the liabilities of financial institutions totaled RMB 452.17 trillion, also up 7.5 percent. Banking sector liabilities stood at RMB 408.11 trillion (up 6.5 percent), securities institutions at RMB 11.48 trillion (up 10 percent), and insurance institutions at RMB 32.58 trillion (up 19.7 percent).

-

China’s Monetary Policy Shifts from Prudence to Moderate Easing

For 15 consecutive years, China maintained a prudent monetary policy. However, to stimulate economic growth, the People’s Bank of China (PBoC) began implementing measures such as reserve requirement ratio (RRR) and interest rate cuts at the end of 2021—moves that have continued largely unaffected by the Federal Reserve or the European Central Bank’s tightening actions aimed at curbing inflation. Throughout this period, the PBoC has remained committed to a stable and supportive monetary stance.

In 2024, China’s monetary policy remained accommodative. The central bank implemented two RRR cuts totaling 100 basis points, injecting over RMB 2 trillion in long-term liquidity. This ensured reasonable growth in total financing. By the end of 2024, total social financing stock had grown by 8 percent, and the outstanding balance of RMB loans reached RMB 255.7 trillion. Broad money supply (M2) stood at RMB 313.53 trillion, up 7.3 percent year-on-year. Currency in circulation (M0) reached RMB 12.82 trillion, a 13 percent increase, with a net cash injection of RMB 1.47 trillion for the year. The overall cost of financing in the real economy saw a steady decline, strongly supporting economic recovery and improvement.

China is also the world’s leader in mobile payments. With just a mobile phone, people can make payments virtually anywhere. The rapid development of mobile payment systems has not only reduced the reliance on cash but also improved payment efficiency and lowered transaction costs.

Starting this year, the PBoC officially shifted its monetary policy orientation from “prudent” to “moderately accommodative.” By the end of Q1 2025, the M2 balance had exceeded RMB 326 trillion, growing by 7 percent. Narrow money supply (M1) reached RMB 113.49 trillion, up 1.6 percent. M0 stood at RMB 13.07 trillion, up 11.5 percent. As of the end of March 2025, China’s total social financing stock was RMB 422.96 trillion, a year-on-year increase of 8.4 percent. Of this, RMB loans issued to the real economy amounted to RMB 262.18 trillion, accounting for 62 percent of the total, and grew by 7.2 percent. The balance of government bonds reached RMB 84.96 trillion, marking a 19.4 percent increase.

3. Five Pillars of Financial Reform

China is making comprehensive efforts to develop five key areas of finance: technology, inclusive, green, digital, and pension finance.

In technology finance, by the end of 2023, medium- and long-term loans to high-tech manufacturing, loans to technology-based SMEs, and loans to “specialized, refined, differentiated, and innovative” (SRDI) enterprises had grown by 34 percent, 21.9 percent, and 18.7 percent year-on-year, respectively—significantly outpacing the overall growth of loans.

In inclusive finance, China is increasing financial supply to underserved sectors to promote common prosperity. Financial support for micro and small enterprises (MSEs) has been strengthened. By the end of 2023, the outstanding balance of inclusive MSE loans was RMB 29.4 trillion, up 23.5 percent year-on-year, with 61.66 million active borrowers. Additionally, financial services for rural revitalization have deepened. Similarly, the balance of agricultural-related loans reached RMB 56.6 trillion, up 14.9 percent, with its share of total loans rising from 21.8 percent at the end of 2020 to 24.7 percent. Policies on guaranteed start-up loans have been enhanced, raising the maximum loan limits to RMB 300,000 for individuals and RMB 4 million for enterprises, supporting entrepreneurship and employment among key groups.

In green finance, China leads the world in scale. Efforts include improving the green finance policy framework, refining standards, and enhancing green credit statistics, forming a comprehensive system based on the “three major functions” and “five key pillars.” Structural monetary tools have been effectively leveraged, including an RMB 800 billion carbon-reduction support facility and an RMB 300 billion special re-lending program for clean and efficient coal utilization. These initiatives have driven the expansion of green credit. With China’s dual carbon goals (carbon peaking and carbon neutrality), green loans have maintained annual growth rates of over 20 percent. By the end of 2023, the outstanding green loan balance reached RMB 30.1 trillion—2.5 times the balance at the end of 2020 and a year-on-year increase of 36.5 percent, 26.4 percentage points higher than the overall loan growth rate. At the end of that same year, cumulative issuance of green bonds had exceeded RMB 3.4 trillion, with outstanding green bonds reaching RMB 1.9 trillion.

The Stable Development of China’s Financial Sector

China’s financial sector, driven by steady development, ongoing reforms, and greater opening, has become an integral part of the global financial system. As a major financial power accelerating its path toward becoming a financial powerhouse, China has actively contributed to both domestic growth and global economic expansion. Structural optimization within China’s financial system—including efforts to increase the share of direct financing—has created new opportunities for global financial markets. With strong technological integration, rapid progress in fintech and digital finance, and a world-leading mobile payment infrastructure, China has generated positive spillover effects that are facilitating the evolution of global finance. Moreover, China’s financial opening has brought substantial opportunities to the world, fostering shared development and mutual prosperity.

First, the potential of China’s financial sector lies in the structural strengths of its system. Currently, direct financing accounts for less than 30 percent of total financing in China, compared to over 50 percent in the United States, Europe, and Japan. One of the key goals in building China into a financial powerhouse is to raise this share and further optimize the financial structure. This shift creates significant development prospects for capital markets and will accelerate the growth and maturity of China’s capital market system.

Second, China’s financial reform and opening reflect a high-level approach to global engagement, offering enormous opportunities worldwide. The current state of China’s financial markets indicates vast room for growth. The expansion of external access—across banking, securities, insurance, and asset management—has removed ownership restrictions, allowing both wholly foreign-owned and joint-venture institutions to establish a presence in China. Reforms such as exchange rate liberalization and the full marketization of interest rates have also gained traction. The internationalization of the renminbi has accelerated, making it the world’s fourth most-used payment currency, after the U.S. dollar, euro, and the British pound. Since joining the IMF’s special drawing rights basket in 2016, the global use of the RMB has continued to rise.

Third, China’s financial development has introduced much-needed stability and opportunity to the global financial system. In addition to achieving its own stable progress, China has actively promoted reforms at institutions like the World Bank and the IMF, enhancing global financial resilience. China has also partnered with India, Russia, and Brazil to establish the BRICS New Development Bank, with a registered capital of $100 billion and a $100 billion contingency reserve arrangement.

Lastly, the high technological sophistication of China’s financial sector boosts efficiency and reduces costs. Mobile payment systems are now widespread across the country. With the open-source development of platforms like DeepSeek, artificial intelligence is increasingly applied in finance, particularly in areas such as data and algorithm optimization. This not only lowers operational costs and improves financial performance but also plays a vital role in advancing inclusive finance.