Martin Bruncko is a technology entrepreneur, investor, policy leader, and Founder and CEO of Steam Ventures. His previous roles have included Executive Vice President for Europe at Binance (the largest crypto exchange in the world), Innovation Minister and Deputy of the Finance Minister of Slovakia and Senior Advisor to the European Commissioner for

Martin Bruncko is a technology entrepreneur, investor, policy leader, and Founder and CEO of Steam Ventures. His previous roles have included Executive Vice President for Europe at Binance (the largest crypto exchange in the world), Innovation Minister and Deputy of the Finance Minister of Slovakia and Senior Advisor to the European Commissioner for

Research and Innovations. You may follow him on LinkedIn at LinkedIn.com/Bruncko.

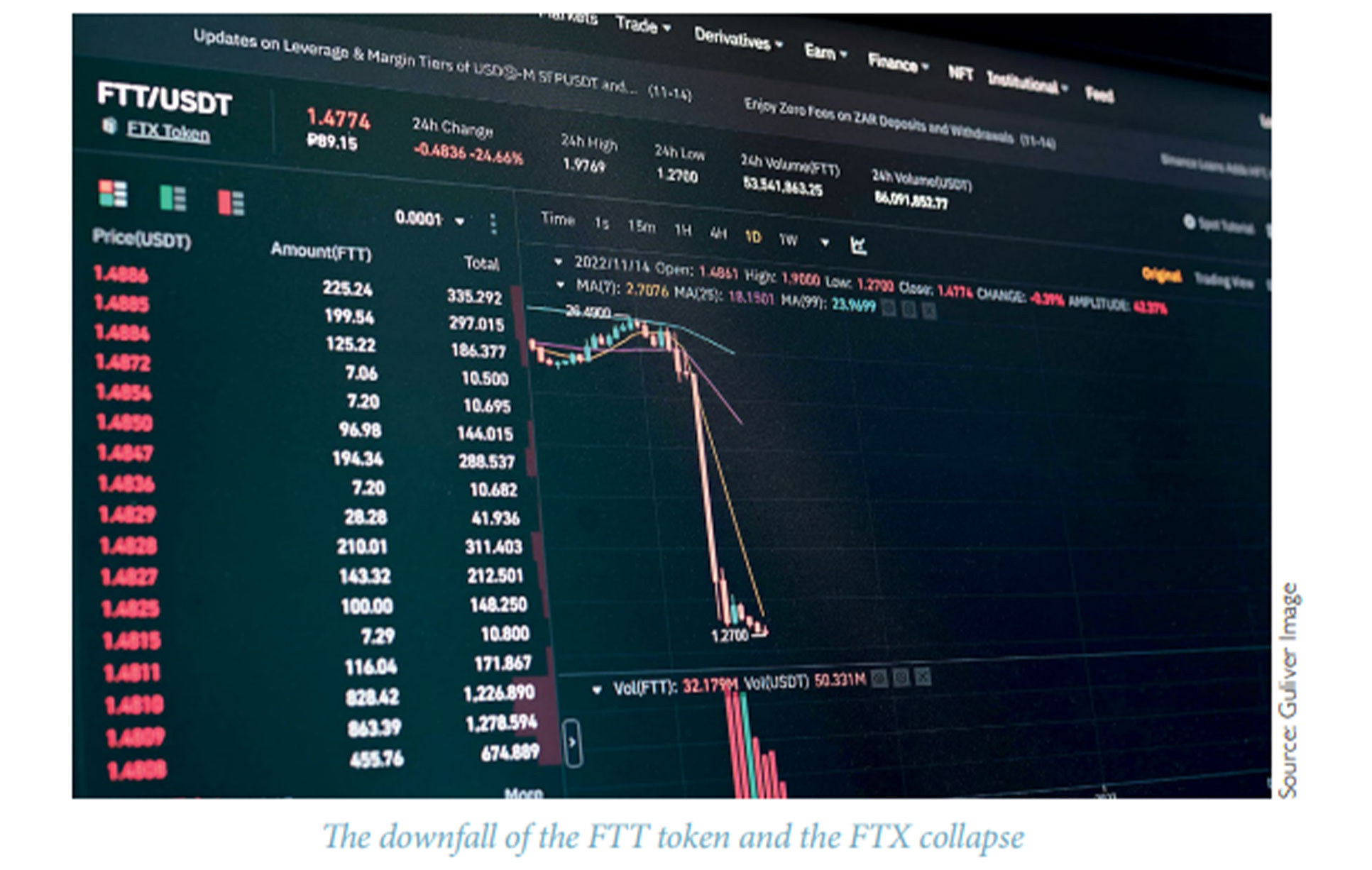

The crypto sector has always had a “Wild West” reputation. From its early days, when cryptocurrency exchanges were accused of laundering money for drug traffickers and warlords, to billion-dollar scams and frauds of the recent past, crypto has been seen as a hotbed of criminal activity. The scandals have been evident over the past 18 months, with the spectacular collapses of the likes of the Terra-Luna token ecosystem and, notably, the FTX crypto exchange.

Yet, within the crypto ecosystem, there is a strong sense of victimization and a perception of unfair prosecution by governments. Many in the crypto community believe that governments are inherently antagonistic toward crypto and simply want to destroy it. This should not be surprising, especially considering recent high-profile actions by regulators in the United States against major crypto companies and crypto-related infrastructure in general, such as banks providing banking and payment channels to crypto companies.

This article examines this sense of war on crypto by governments and whether there is any truth to it. It further analyzes what the future might bring for the relations between governments and companies leveraging blockchain technology. This is an important question given that what is broadly believed to be the next iteration of the Internet—the so-called Web3—is effectively built on blockchain. Much of it will deeply rely on cryptocurrency tokens, including non-fungible tokens (NFT). We will examine why the governments have been concerned about crypto and whether they have been right.

I believe that the claim that governments are fundamentally against crypto is a myth. Debunking this notion is crucial because it damages the further growth of the crypto technology sector. My argument in this article is that the real problem has effectively been the lack of regulations and regulatory clarity. Although the decision of many governments, including the UK and the United States, not to regulate the nascent crypto industry was initially the right one, it also paradoxically turned out to be an obstacle to its further maturation. The crypto sector is thus an example of why good regulation matters and can effectively serve as a driver for the healthy growth of an entirely new industry. Those countries succeeding in this will see their economies reap massive benefits.

Trouble in the Crypto Land

During its short history, lasting barely more than a decade, many significant events have cast a shadow over the cryptocurrency world, highlighting the challenges and risks of this rapidly evolving industry. Among the earliest was the Silk Road scandal, involving the notorious dark web marketplace. It ended with the arrest of its operator, Ross Ulbricht, in 2013. The charges against him included drug trafficking, money laundering, and other crimes, revealing the illicit activities on this platform. All transactions on Silk Road were conducted with Bitcoin. Similarly, the BitMEX scandal involving the cryptocurrency derivatives exchange founded by Hayes, Delo, and Reed saw allegations of providing money laundering to criminals. It became the first cryptocurrency exchange to be indicted by the U.S. federal government in 2020. Then there were numerous scams. For example, the Plus Token Ponzi scheme, a high-return investment program that turned out to be a cryptocurrency scam, generated a staggering $2.9 billion in 2019, making up a substantial portion of cryptocurrency-related crimes. Plus Token attracted investors unfamiliar with cryptocurrencies, offering enticing rewards that lured victims into “investing,” promising monthly returns ranging from 9 to 18 percent. Another noteworthy scandal was Thodex in Turkey. Under the guise of providing better service to users, this cryptocurrency exchange platform abruptly announced its temporary closure, raising suspicions among users who couldn’t access their accounts and funds. Thodex’s CEO, Özer, allegedly received $2 billion in funding from 391,000 investors and fled abroad, leaving thousands of Turkish users as victims.

Recent high-profile crypto failures have included the crash of the Terra-Luna ecosystem and the collapse of a leading crypto exchange, FTX. Terra-Luna, once touted as a trailblazing crypto-currency project, faced a sudden collapse due to various factors, including technical issues, market volatility, and governance challenges. These ultimately led to a loss of trust among investors and users, collapsing its token value. It is estimated that $60 billion got wiped out of the digital currency space due to the Luna token crash. The Luna collapse also largely contributed to the collapse of FTX. With millions of users and a daily trading volume often exceeding $10 billion, FTX had previously established itself as a major player in the crypto market with a valuation of more than $30 billion. According to John Ray III, who was appointed to oversee the bankruptcy and restructuring of FTX, the crypto exchange collapsed because of a “complete failure of corporate controls” and an “old-fashioned embezzlement.”

After the collapse of FTX, U.S. authorities have significantly increased their activities against the crypto sector. Coinbase, a Nasdaq-listed company and one of the largest cryptocurrency exchanges, had agreed in January 2023 to a $100 million settlement with the New York State Department of Financial Services (NYDFS) over allegations of violating anti-money laundering laws. In June 2023, Coinbase was also sued by the U.S. Securities and Exchange Commission (SEC), which accused it of operating illegally as a national securities exchange, broker, and clearing agency without registering with the regulator. Ripple, the company behind the digital asset XRP, has also faced a high-profile lawsuit from the SEC, which alleged that XRP was an unregistered security. However, in July 2023, Southern District of New York judge Analisa Torres ruled that the XRP token is not a security when sold to the general public. It was a landmark legal victory for the cryptocurrency industry because of its significant implications for classifying cryptocurrencies under U.S. securities laws. Last but not least, the world’s largest crypto exchange, Binance, has been accused by CFTC and SEC of breaking U.S. laws, including by operating unregistered exchanges, mishandling customer funds, and illegally offering commodity derivatives transactions to U.S. persons.

More fundamentally, the U.S. federal regulatory bodies seem to employ all available tactics to disconnect the cryptocurrency industry from essential banking services. Industry analysts have dubbed this purported endeavor “Operation Choke Point 2.0,” likening it to a previous push by the Obama administration to sever ties between banks and certain businesses like firearms dealers and payday lenders, which were legal but believed to be high risk for fraud and money laundering.

Why Still Care About Crypto?

With all the overhyped expectations that never seemed to be fulfilled and more than its fair share of crashes and scandals, it would be easy to dismiss the crypto industry as, at best, irrelevant and, at worst, outright dangerous. However, this would be an overreaction. Blockchain and cryptocurrencies are indeed a breakthrough technology with massive potential. Crypto has often been seen as just another technology wave. While this is true, cryptocurrencies also stand apart from the traditional tech sector in a fundamental way. They are not just “tech”—they are also “finance.” A simple way of explaining crypto is as a better technology for storing and moving financial value. In other words, a better way of “doing money” or simply another iteration of finance.

The [blockchain] technology and the [crypto] industry are still in their early stages. In a sense, we could say that it is now roughly where the Internet was at the end of the 1990s. Many unbelievable claims were made back then about the Internet, which seemed like massive exaggerations. In particular, many economists argued that the Internet will positively transform the entire economy and give it a massive growth boost. With hindsight, these predictions were completely right. The economists based their arguments on a simple idea that is one of the foundations of modern economics: the more and better information people have, the better the economy works. And the Internet is just an amazing machine for giving people access to information. So, of course, it would create an economic earthquake. It was unclear how this would happen and what shape and form the earthquake would take, but the outcome was inevitable.

Similarly, as money is the bloodline of every economy, a better technology for “doing money” means the entire economy will massively benefit from it. One example is the so-called “tokenization” of traditional securities, which means “putting them on the blockchain” and turning them into cryptocurrencies that can be freely traded. This will significantly increase the liquidity of financial markets, access to capital, and access to investments. In their first iteration, security tokens debuted most notably during the big Initial Coin Offerings (ICOs) wave around 2017. While numerous ICOs were of dubious quality or outright scams, there were also many high-quality projects developed by teams outside the typical technology hubs, such as Silicon Valley or Northern Europe. Thanks to ICOs, they raised hundreds of millions of dollars in funding through this new financial technology. There is no way this would have been possible for them through the traditional venture capital (VC) industry.

Looking at the issue from a reversed angle, ICOs, in turn, enable ordinary retail investors to get investment access into relatively early-stage but highly promising technology companies, which have historically been uniquely available only to leading VCs. Likewise, tokenizing other financial instruments, such as government bonds or carbon permits, will enable their full fractionalization, i.e., the ability to break them down into small parts, and easy sale to and trading even by retail customers who currently have no access to such investment products. Moreover, trading them 24/7 on centralized crypto exchanges or via DeFi will be possible, further increasing their liquidity. But the potential impact of crypto and blockchain goes beyond the money aspect.

The nonfungible tokens (NFT) are a particularly interesting development. The technology became famous for its very expensive digital drawings about two years ago. However, its real promise lies in something very different. We have lived in a digital economy for the past several decades. The fundamental building block of the digital economy has been the digital file. While it has many benefits, the digital file also has a major weakness: it can be infinitely copied after which the original file can never be identified because all copies of the file are identical. As such, assigning ownership to a concrete digital file is impossible. But every economist will tell you that clearly assigned property rights are a basic pre-condition for a well-functioning economy. Now, the NFT technology solves this problem. It is essentially a tamper-resistant tag that makes it possible to make any digital file uniquely identifiable—and, therefore, clearly assign property rights to it. While this might sound quite theoretical, it is effectively of the same importance as the Internet making the economy much more efficient by giving its actors access to better information.

The major TradFi companies understand this technological promise of crypto. This is why despite all the bad press that crypto has received, they have continued to invest more into it even in 2023. Recent examples include Visa offering settlements in crypto via stablecoins, Goldman Sachs building a crypto and Web3 practice, Blackrock applying for a Bitcoin ETF and Citadel, Fidelity, and Charles Schwab launching a crypto exchange. Similarly, companies like Adidas, Nike, and LVMH have been implementing NFTs for use cases ranging from rewards programs to proofs of origin. In December 2022, Starbucks started issuing NFTs to its customers that serve as an extension of its rewards program. It never used the term NFT in its communication. Nevertheless, they have since generated hundreds of thousands of dollars in sales for the company.

The Main Risks in Finance and Crypto

The fact that crypto is essentially a new iteration of financial services has several profound implications. Most crypto companies are structurally not different from companies operating in traditional finance, or TradFi, as it is called in the crypto jargon. Governments, at least the sophisticated ones, have realized this. As such, they inevitably looked at crypto through the frameworks they have traditionally used to evaluate traditional finance. The Western regulatory frameworks have evolved to focus on four major categories of risk in finance.

Financial Crime: One of the primary concerns for governments when assessing risk in the financial sector is preventing financial crime, with a particular focus on combating money laundering. Illicit financial activities, such as money laundering, terrorist financing, and tax evasion, pose significant threats to the integrity of the financial system, public finance, and national security. Governments, therefore, impose strict anti-money laundering (AML) and Know Your Customer (KYC) regulations on financial institutions that make them responsible for identifying the people carrying out and benefiting from financial transactions and the sources of the funds they transact.

Consumer Protection: Governments are also deeply invested in safeguarding the interests of consumers within the financial landscape. A key risk they seek to address is ensuring that consumers are not allowed to purchase financial products that they do not fully comprehend and, thereby, incur substantial financial losses. History has shown crooked companies and salespeople taking advantage of uninformed consumers. To address this risk, governments regulate the sale of financial instruments to retail customers, requiring companies to disclose risks, provide transparent information, and ensure suitability for their clients’ needs and risk tolerance.

Market Integrity: Maintaining the integrity of financial markets is critical to ensuring the fair and efficient functioning of governments and their economies. Governments are vigilant about preventing market manipulation and insider trading, which can distort prices, undermine investor confidence, and compromise the integrity of financial institutions. Regulators closely monitor trading activities, investigate suspicious transactions, and enforce penalties for those found engaging in fraudulent practices. Market surveillance and strict enforcement of regulations are essential to upholding market integrity.

Financial Stability: The overall stability of the financial system is of paramount concern for governments. They aim to prevent problems in specific markets or segments of the financial sector from spiraling out and causing widespread damage to the broader economy. For instance, cheap credit and lax lending standards led to a financial bubble in the housing market in the 2000s. When it burst, the banks were left holding trillions of dollars of worthless investments in subprime mortgages. Their subsequent collapse had far-reaching consequences on the broader economy, affecting employment, investment, and overall economic growth. To mitigate this risk, governments implement prudential regulations, conduct stress tests, and establish mechanisms to respond swiftly to emerging threats, thereby enhancing the financial system’s resilience.

Too Small to Care, too Unclear to Follow

For a long time, the Western governments did not consider most of the above risks relevant in crypto. The crypto industry was too small in terms of actual market size and the number of people using it. For the most part, only financial crime was considered a real problem. But even though it was believed to be potentially large, the governments felt that existing tools regulating TradFi could easily be extended to crypto.

As a result, the crypto sector has found itself with little or no regulation in most parts of the world. Only a handful of countries have opted for the opposite strategy: some, like Pakistan, have partially banned crypto, while others, like China, have implemented a full ban. In comparison, the West opted for a light-touch approach. In most European countries, crypto regulation has been almost uniquely limited to applying the existing money laundering rules and regulations to companies dealing with crypto. Only a handful of EU countries developed a regulatory framework for this nascent industry. Paradoxically, the first one of them was Malta in 2018. Paradoxically because its financial sector has often been considered as not the most vigorously regulated. Malta drew a valuable lesson from its previous attempt to become a leading global jurisdiction providing regulatory clarity to the online gaming and gambling industry. It was an area that few other jurisdictions wanted to touch. However, after Malta became one of the pioneers in regulating the gaming industry, it became a huge contributor to its economy, accounting for more than 10 percent of its GDP.

Almost equally paradoxically, the two global leaders in traditional finance, the United States and the United Kingdom, often held as paragons of legal clarity and the rule of law, have been among the most problematic jurisdictions when it comes to crypto. Until today, neither of them has provided clear rules and regulations for crypto companies. In both cases, the legislator has not made any new crypto-specific laws and left the decision on how to fully regulate this developing industry to the existing regulatory agencies for the financial market. The implicit assumption was that the existing regulations for the financial industry are enough and can be fully extended to crypto as needed. However, in both cases, the regulatory agencies have struggled. What is worse, in the United States, there has been little agreement between the CFTC and the SEC as to who is in charge of the sector. This is not entirely surprising, as the technology is just emerging, and it has not been trivial to determine whether a crypto asset, such as bitcoin, should be considered a security, commodity, or something else entirely. But if the government regulators cannot agree among themselves on what rules should apply to crypto, how can the crypto companies be expected to know, let alone follow the rules? While some rules should be obvious to everyone—such as don’t lie about your product and goals to your customers—others are much less so, especially in an emerging technology field. These questions can be very complicated ones, such as how the internal and external information technology risk should be managed (including things like management of crypto wallet keys and employee access rights to various IT systems) and what is the nature of various crypto assets and, therefore, who can and cannot issue and distribute them (such as which asset should be considered a security).

In the absence of clear crypto regulations worldwide, self-regulation has largely been the norm in the industry. Now, self-regulation can be highly leaky and problematic even in mature markets, as companies feel little incentivized to restrain themselves from activities that limit their profits. In crypto, it became doubly so. The crypto industry is almost new, with very few fragile and self-governing bodies. More fundamentally, the core of the crypto community has historically been strongly libertarian and anti-government. As such, the lack of compliance with the rules and norms of traditional finance has been a feature, not a bug in crypto. Many of the most influential crypto ventures and crypto-native firms were explicitly set up as an alternative and in opposition to the traditional financial industry, which they have viewed as being in the clutches of governments.

Many key opinion leaders in crypto believe in absolute privacy, including the right to keep the government away from information about one’s financial situation and transactions. Of course, most of the crypto industry’s actors are not criminals; these are just philosophical tenets they hold dear. But there should be no surprise that with little outside regulatory guidance, let alone scrutiny and enforcement, lax norms and occasional bad apples have proliferated. Add to this one final element: the sector is brand new and extremely fast-moving, and crypto companies and projects have often been growing at a break-neck pace. It has not been uncommon to see crypto projects that have amassed tens of millions of customers in just a couple of years. In all other tech sectors, two year-old-companies would be considered early-stage start-ups—still babies, in other words. Expecting such two-year-olds to implement regulatory compliance systems that most traditional financial companies have taken decades to implement might be a stretch. Especially if the company is based on another continent and does not even have any local operations in the country whose regulatory regime—often completely unclear on crypto—is concerned.

The Industry and Risks Grow

The risk perception of the crypto industry by the governments has changed quite significantly over the past two years. Between May 2020 and May 2021, the total market capitalization of all crypto assets grew almost tenfold. The crypto market is still minuscule compared to TradFi. Its total size is less than one percent of the global equities market. But that still represents more than $1 trillion market cap and more than $40 trillion in trading volume in 2022. More importantly, crypto is no longer a highly niche activity limited to a small group of libertarians, eccentrics, and tech geeks. More than 5 percent of people in Europe own crypto. In the United States, it’s believed to be more than 10 percent. The total number of cryptocurrency owners globally crossed 420 million individuals in 2023. Of course, the governments started to pay attention. With its growth to a trillion-dollar industry that has attracted institutional investors, retail participants, and significant public interest, the sector’s impact on financial markets, investor sentiment, and economic stability has increased significantly.

The potential for money laundering and illicit activities remains a significant concern for governments, especially with the development of privacy-centric cryptocurrencies and decentralized exchanges. As criminals continue to exploit the relative anonymity of certain digital assets, regulators are adapting their approaches to stay ahead of evolving threats. Despite all the major cryptocurrency companies and exchanges implementing stricter KYC and AML rules, blockchain analytics company Chainalysis discovered that in 2022 the share of all cryptocurrency activity associated with illicit activity has risen for the first time since 2019 but it is still very small: from 0.12 percent in 2021 to 0.24 percent in 2022. With sanctions against Russia, Iran, and others, the sanctions-related transaction volume rose by a staggering 152,844 percent from 2021 to 2022. Likewise, consumer protection has become a more pressing concern with the expansion and proliferation of various digital assets. Many retail investors, enticed by the promise of quick profits, have fallen victim to scams, fraudulent projects, and Ponzi schemes, such as the Plus Token mentioned above. Furthermore, as the crypto market grew, so did the risks of market manipulation, insider trading, and systemic vulnerabilities. The interconnectedness of traditional financial institutions with the crypto sector, although still relatively small, means that any instability within crypto markets could potentially have broader ramifications for the global financial system.

Moving Forward: Friendly Clarity Wins

Was the decision not to regulate crypto explicitly in the past wrong? Not necessarily. Setting stringent rules for how a new technology can and cannot be used or how a new industry should operate is often the surest way to kill it. Over-regulation often has the undesired effect of constraining innovation. As innovations have been the main driver of economic growth in the modern era, no government interested in its citizens’ well-being wants to restrict it. The problem with early-stage technologies is that it is tough to tell where sufficient rules for providing adequate regulatory clarity end and where overregulation begins. Blockchain and crypto are examples of extremely fast evolving technology, where even the developers and pioneers at its core do not know in which direction and into what products the technology will evolve. A well-intentioned rule designed to prevent a potential negative effect of the technology might completely block the development of a new type of product whose benefits might be several orders of magnitude larger than the targeted negative effect. A good example of this is Japan. Japan was the early leader in crypto. Most of the largest crypto exchanges started there. However, concerned about consumer protection, the government imposed a list of cryptocurrencies that could be traded on exchanges in Japan. As a result, the local exchanges were listing less than 20 assets. As the number of great crypto projects grew, but the government failed to expand its list, most leading crypto exchanges moved elsewhere, where they could list hundreds of assets. This included the world’s largest and most successful crypto exchange, Binance. Ironically, Binance originally moved to Japan from China when the Chinese government banned crypto exchanges several months after it was launched in 2017. The Japanese government eventually realized its mistake and significantly eased its listing restrictions recently, but it is likely too late for the Japanese crypto ecosystem to recover to its previous world-leading position.

What does this all mean going forward? First and foremost, it should be clear by now that governments that want to encourage the development of local crypto ecosystems need to provide a clear and innovation-friendly regulatory environment. The worst situation is a lack of regulatory clarity combined with harsh enforcement. Subjectively, this creates an impression of arbitrary actions by the government. Objectively, it forces the companies pioneering the emerging technology to avoid building products that might be considered potentially risky from a regulatory perspective. A good example of this are tokenized securities. Given the lack of clear regulations and harsh actions by the SEC regarding alleged breach of securities rules, most early-stage crypto projects avoid building any innovative products that SEC might consider as a security. At best, those projects ensure that American customers cannot access such products under any circumstances. Such drastic self-constraint is very expensive for crypto projects and not in the best interest of U.S. businesses and consumers. At worst, stringent enforcement of what is perceived as insufficiently clear rules by the industry players might push the best emerging companies out of the country entirely—an example of which is the treatment of Binance and other leading crypto exchanges in Japan.

The winners in this new technology wave will thus be the countries that create the required regulatory clarity for the crypto industry and encourage its development locally. A great example of this is UAE and France. France was a relatively early adopter of clear and light-touch crypto legislation. Moreover, it has a progressive regulator that has been constructively working with crypto start-ups and a government that has explicitly welcome crypto companies from abroad that have decided to start operations in France. Similarly, Dubai has become one of the leading global crypto hubs thanks to its business-friendly government, no income and corporate taxes on most companies, and its government’s active drive to build a balanced regulatory framework for crypto. One place that is particularly well-positioned to become the global winner in this current technological wave—and for the first time since the advent of the Internet—is the European Union. It will soon become the first advanced economy with a clear but light-touch regulation. The so-called Markets in Crypto-Assets Regulation, better known as MiCA, will come into force in 2024 and it very much strikes the right balance between minimizing the risk coming from crypto and avoiding overregulation. It also creates a truly single market in crypto for the EU’s 450 million consumers. And all of this in a situation when Europe already has the world’s largest crypto economy accounting for about 25 percent of all crypto activity worldwide. It also has one of the most vibrant crypto ecosystems in the world that gave rise to many of the leading crypto projects, including Ethereum, which was formally launched out of Switzerland. In comparison, the United States seems to be significantly behind. Nevertheless, the European politicians championing EU tech leadership should not be popping champagne just yet. As many have learned in the past, to their own chagrin, the United States can self-correct and move very fast, so do not write it off prematurely.