Bert Hofman is Director of the East Asian Institute at the National University of Singapore and Professor of Practice at the Lee Kuan Yew School of Public Policy. You may follow him on Twitter @berthofmanecon.

Bert Hofman is Director of the East Asian Institute at the National University of Singapore and Professor of Practice at the Lee Kuan Yew School of Public Policy. You may follow him on Twitter @berthofmanecon.

In his March 2015 TED Talk on a future global flu epidemic, Bill Gates probably wanted to mention a really big number for the costs that such a pandemic could impose onto the world. So he quoted an astronomical $3 trillion. At the end of March 2020, the extraordinary G20 leaders meeting on the COVID-19 virus pledged $5 trillion in policy measures to fight the virus and the economic impact of the measures to control it. The total fiscal response of all members of the IMF added up to $8 trillion, or some 8 percent of global GDP, by end-March. And the IMF’s Fiscal Monitor projects that global fiscal deficits will be 10 percent of global GDP, triples that of last year. Even this may not be enough.

The good news is that—unlike during the global financial crisis of 2008-9 —there is little disagreement on the need for a massive economic policy response. Driven by collapsing stock and bonds markets, the “whatever it takes” moment took weeks rather than months (or even years) to arrive, as it did after the global financial crisis. Indeed, the G20 leaders meeting came within two weeks of the World Health Organization’s (WHO) declaration of a pandemic. In the middle of diplomatic spats and blame shifting in the weeks before the (virtual) meeting, it was remarkable that the G20 could come up with a joint and forceful statement at all.

In contrast to 2008-9, few if any are asking the question of who will foot the bill. The U.S. Congress—which back in 2008 had to think twice about a $700 billion “TARP” program to save the financial system, and later short-changed the Obama Administration on its fiscal stimulus—as an initial step approved $2 trillion, some 10 percent of gross domestic product (GDP). The Federal Reserve Board—after announcing it revamped its extraordinary discount window to the tune of $1.5 trillion in March—topped this up with another $2.4 trillion in promised asset purchases less than a month later. Japan has announced a fiscal and monetary package of some 108 Trillion Yen, or 20 percent of GDP. Even for Germany, the ‘black zero” (schwartze Null) is no longer the holy grail for fiscal policy and the government has announced a 750 billion euro package in new spending and lending from KfW, a development bank. Meanwhile, the EU failed to agree on a “Corona Bond,” but at the time of writing there seems to be growing convergence on a Spanish proposal to include some 1 trillion euros of corona support in the regular EU budget.

Of course, if not now, when? Interest rates on government bonds are at record lows in the wake of a flight to safety. Those on German Bunds are negative and the yield on ten-year U.S. Treasuries is below 0.5 percent. It does not take “modern monetary theory” to figure out that the time to spend is now. Helpful also was that monetary authorities did not need to reinvent the wheel: they could simply restart their asset purchase program and further open existing emergency discount facilities. Thus, the response was swift when it came and central banks are no longer the only game in town.

Delays

The bad news is that in most countries the delay in response to the epidemic will make fighting it much more expensive in terms of lives lost and in terms of the economic impact. First was the delay in China, detailed in an article published in the respected Caixin Magazine. The epidemic might just have been contained in the city of Wuhan, if the authorities had acted on the information available by the end of December 2019.

Instead, politics got in the way (in this case the rather insignificant political meetings in Wuhan municipality and Hubei province). By the time serious action was taken in late January 2020, the virus was already all over China and had started to spread internationally. It took extraordinary measures to contain the virus in China: basically, the central government shut down the economy—an exceptional move in a year that was meant to deliver 5.6 percent GDP growth to meet the Communist Party’s “Centennial Goal” of a “moderately prosperous society.” In all likelihood, this goal will have to wait at least another year.

The second delay came from the slow response in countries around the world. From denial to trivialization of the numbers, to mistaken beliefs on the viability of “herd immunity” and to logistical challenges to get virus testing in place, all held up policy responses in most of the West.

The United States, in an election year, was particularly lethargic in its response at the federal level, led as it is by a president who seems more concerned that a forceful reaction to the virus would lower “his” stock market numbers. As a result, precious time was lost. A redeeming feature for the United States was the swifter actions at the state and local levels: states like California and Washington already seem to have turned the corner. Nevertheless, the United States, Italy, the UK, and numerous others have now overtaken China in terms of the number of infected people, though doubts remain at this stage how accurate these numbers are.

Contrast this with some of China’s Asian neighbors: the SARS and MERS epidemics are still vivid memories that have imbued authorities in those countries with a strong dose of common sense in addressing a virus threat. The governments of Taiwan, Korea, Singapore, Hong Kong, and Japan, each in their own specific ways, reacted early and forcefully, stepping up efforts as the storm outside their borders intensified. Measures to enforce “social distancing” and change behavior to a varying degree were complemented with extraordinary efforts to monitor, test, identify, and isolate the infected as well as trace their contacts and take active follow up measures.

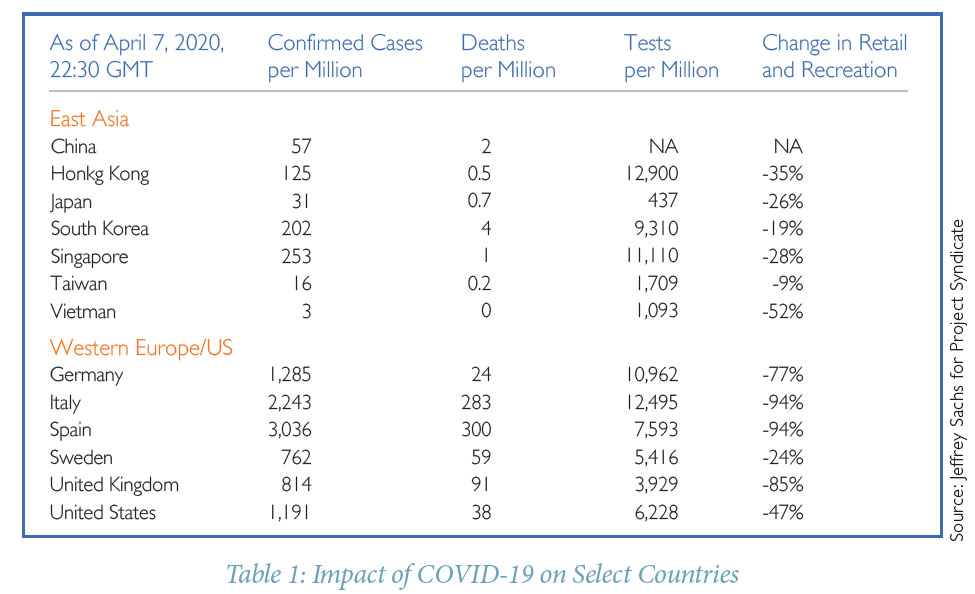

Timeliness matters. As Jeffrey Sachs, a development economist at Columbia University and key advisor to the UN has pointed out, most Asian countries now look better than countries in the West in terms of number of victims and even economic impact (see Table 1). True, the quality of the numbers across countries vary, and some put doubts on the number of infections and victims reported from China, but number of deaths is harder to cheat on. In addition to health outcomes, the economic impact, as measured by the impact of control measures on retail and recreation (an economic variable that is readily available from Google) shows that the economic activity in Asian countries declined by less than in Western countries.

Timeliness of the international response was not aided by the WHO’s belated declaration of human-to-human transmission, which is key for a virus response to evolve from a local matter to a potential epidemic. The warning came three weeks after eight courageous doctors in Wuhan and Taiwanese authorities had already warned against it. The Organization was also reluctant, for a time, to call the epidemic a pandemic—a sign that the virus had spread to many countries in the world.

To be fair, there is no hard science to tell whether there is a pandemic or not, and the WHO had abandoned its own system for doing so after the H1N1 episode. Yet, declaring a pandemic obviously works as a wake-up call and when the WHO did so on March 11th, most countries put their response into high gear.

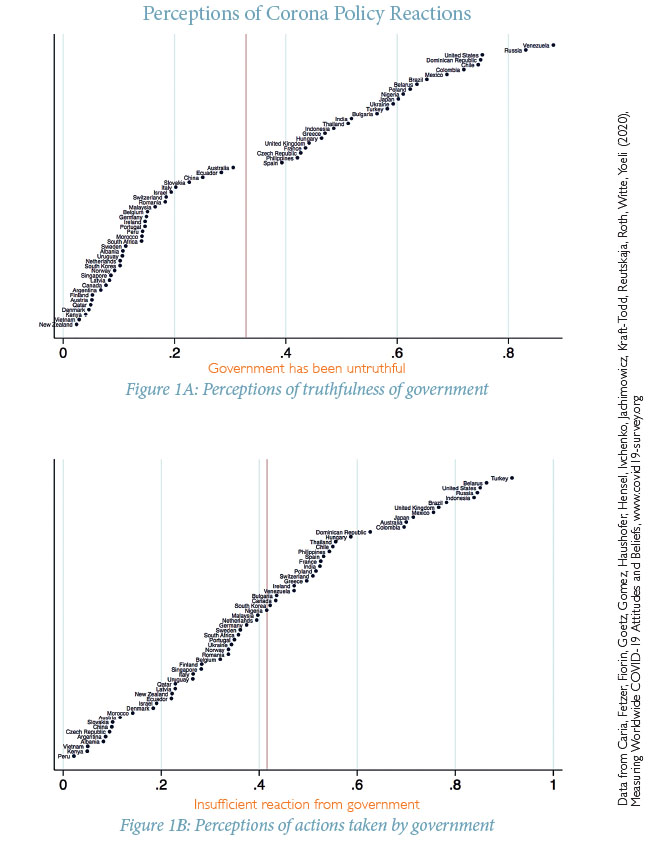

Not a moment too soon, as people were losing confidence in their governments. An extremely timely and large-scale survey done in mid-March by a group of researchers from 12 different institutions, including Harvard, Cambridge, IESE, and Warwick University, sheds more light on this. The findings suggest that many people around the world have little confidence in the words and actions of their government in response to the virus (see Figure 1A and 1B).

Among OECD countries, the United States particularly stands out: the vast majority of people felt that the government had been untruthful and done too little. Opinions in Japan were also less favorable than most would have expected, perhaps because until recently, the government was still seen to be weighing measures to contain the virus against the chances of holding the Olympics this summer. These have now been postponed.

In contrast, most people in the smaller Asian countries have high confidence in the actions and words of their government. The survey also reveals a sharp change in personal behavior (social distancing, stay home, washing hands, cough in your tissue or elbow, isolate the sick) around the world, which gives hope for turning the tide on the pandemic.

China and Worse than China

The economic impact of the pandemic is staggering. The measures needed to halt the epidemic from getting out of control put a sudden stop to the world economy. China, which was first to lock down its economy, reported a drop in GDP in the first quarter of 6.3 percent compared to the first quarter of 2019.

This was the first negative quarterly growth rate China has ever reported. Even with a rapid recovery in the second quarter—and that is not a given—the country will have a hard time to record growth more than 2 to 3 percent for the year—half the recorded growth of last year, and well short of the 5.8 percent growth China needed to achieve its “Centennial Goal” of doubling GDP between 2010 and 2020.

The rest of the world is likely to fare even worse than China. The IMF projects that the world will fall into a deep recession, deeper than the one that followed the Global Financial Crisis in 2009. Despite the unprecedented policy response that we have already seen, the world economy is projected to shrink by 3 percent in 2020, double the decline of 2009.

Furthermore, even low income countries will barely grow this year, only 0.4 percent compared to 5 percent last year, 4.7 percentage point lower than projected only in January 2020, and the lowest growth since the 1960s. Emerging and developing economies together will fare even worse: GDP is projected to decline by 1 percent in 2020, compared to 3.7 percent growth last year. And all of that could be worse: the IMF’s downside scenario is far worse.

Unlike in 2009, China will not be there to save the world economy. Thus far, China has only been staging a relatively modest economic stimulus, at least compared to the massive one it unleashed in 2008. The strategy seems to be to keep enterprises and banks alive through the shutdown and only boost spending after a return to normal.

Measures taken or announced by the Central Government in Beijing thus far included tax exemptions and tax rate cuts, deferral of social security and health insurance premium payments, and special lending facilities managed by and PBC and state banks. This adds up to some RMB3 trillion, some $400 billion, or a little less than 3 percent of GDP. This is respectable, but far less than the 12 percent of GDP the country announced in stimulus in 2008-9.

Beijing may well plan for more to come, and a March 25 meeting of the Standing Committee of the Politburo on “New Infrastructure” suggests as much. However, the situation now is very different from 2008 and the world should not expect China to once again become the global engine of growth through a debt-fueled infrastructure and real estate construction. Much infrastructure has been built in the past decade and a half, and debt levels of local governments, enterprises and households are now relatively high.

Moreover, the tax base of local governments has been cut recently, and thus too much stimulus may risk the financial stability of local governments. As for households, real estate (which was a big factor in the 2008 stimulus) has been hit hard by the crisis, households are heavily indebted, and the housing market seems saturated. If the Central Government in Beijing deems a larger stimulus necessary, it will likely need to pay for it itself, either by means of larger transfers to local government or households and targeted at consumption rather than investment.

One big opportunity for China to stimulate the economy is to extend a stronger safety net to migrants and rural citizens. While unemployment numbers only increased modestly to 6.2 percent, the figure by and large excludes migrants, of which nearly 100 million had yet to return to work by mid-March, in part because there is no work to return to. Providing support for them, and increasing the support for people in rural areas through more generous pensions and dibao (welfare payments) will not only boost consumption, but also contribute to meeting the goal of eradicating extreme poverty by the end of the year.

Low-income countries are particularly at risk even if their growth rates are for now projected to remain positive. The virus is likely to hit them hard for several reasons.

First, their health systems are far less developed than that of OECD countries or those of China, and the rich East Asian economies currently affected.

Second, while social distancing may be relatively easy for families in wealthy OECD countries, it is a different challenge altogether in the sums of Mumbai, Manila or Lagos.

Third, a large part of the population works in the informal sector without a social safety net or health insurance. Thus they are far more vulnerable to a downturn than workers in the formal sector. While informality has increased across the board and now affects some two thirds of the global labor force, it will strongly drop as income rises, according to a recent ILO report.

Finally, unlike rich countries, the flight to safety increased interest rates for them and thus their governments will find it harder to spend the money needed to contain the virus and counter the economic impact. Capital outflows from emerging markets totaled more than $100 billion in the first quarter of 2020 according to the IMF.

Pledges of Support

To tackle the lack of funds in developing economies, the IMF, the World Bank, and other development organizations have pledged huge support. The World Bank put up an initial program of $14 billion, and pledged up to $160 billion for the effort, which is about half its balance sheet. The IMF doubled its $50 billion emergency facility, pledged $1.4 billion in debt relief for the poorest countries, and even availed its total available funding of $1 trillion to fight the economic impact of the virus. Major creditor countries also agreed to a proposal by World Bank President David R. Malpass to reschedule debt service due for this year. This is a good initiative, and if implemented, will free up cash for health and economic policies in those countries.

What is good for the goose is good for the gander, they say, so the World Bank could set a good example by rescheduling the debt service due to them. Over time, for the next pandemic, this could be institutionalized—at little to no costs to the World Bank: their financing also benefits from the flight to safety and is now cheaper than ever.

Such a rescheduling facility will undoubtedly work better than the existing pandemic facility that was created in the wake of Ebola. That is an insurance facility, with high interest for investors and highly specific conditions for disbursement. It finally was triggered in mid-April, well into the pandemic, and with an amount of PEF bonds and swaps were expected to pay out $195.84 million to be distributed to 76 of the world’s poorest countries: an amount that is tiny compared to the amounts pledged through other channels.

One of the real downside risks for the aforementioned economic projections is that measures to suppress the virus are relaxed too early and that a renewed round of infection would cause a second economic downturn. Even without this, the measures may need to be in place for longer than they have been in China and other parts of Asia. This is in part because many countries implement less extreme measures, and in part because implementation is less consistent than in East Asia. A final risk is that the mechanisms for enduring control of the virus—detection, isolation, and tracking—are not in place to take over after initial suppression.

History suggests that these risks are real: the famous Spanish Flu pandemic at the end of World War I came in three waves. Only a vaccine or a cure—both yet to be discovered—will ultimately stop the COVID-19 epidemic. The alternative, letting the virus run its course and aim for herd immunity to stop it from further spreading, is simply unacceptable. The markets seem to believe that the worse will be over soon, and that public health measures and large economic stimulus packages are enough to get through this.

They may yet be disappointed in the months ahead.

A further long-term risk is that the pandemic will feed protectionism around the world. Diversification from China, the China+1 strategy, which was already on the drawing board in the wake of Sino-American trade tensions, will be reinforced by the disruptions caused by COVID-19. This will hold in particular for essential products such as medical equipment and drugs, for which the pandemic has revealed a high dependence on China that many may wish to reduce in future.

Some trade hawks in the United States, though, want to take the opportunity to go further, and use the epidemic as a further argument to decouple. Even within free trade blocs such as the EU, tensions have arisen on trade in medical supplies and reinstatement of controls at the border to protect against the spread of the virus. Finally, restrictions on food exports, which aggravated the impact of the 2008-9 global financial crisis, is rearing its head again, which could be particularly damaging for developing countries. Thus, the epidemic is increasingly a risk for free trade, which could bring long-term damage to the world economy and slow the recovery from COVID-19.

Finally, the pandemic has become the center of an international diplomatic battle. The United States and China have been exchanging barbs on the origins of the virus, with Trump referring to it (for a time) as the “China virus” and “Wuhan virus,” and a spokesperson of China’s Ministry of Foreign Affairs flogging the unlikely theory (for a time) that the virus originated from the United States and was brought to China by American military personnel.

Beyond these theatrics, the fight against the pandemic is becoming another chapter in the strategic competition between China and the United States. China had to overcome the blow to its image caused by its initial fumbling of the response in Wuhan. After that, however, it has demonstrated a capability to counter the virus at home that few could match, and the country has used its industrial base and diplomatic savvy to help countries around the world with the provision of medical supplies and expertise. This is met with some skepticism in corners of the world, but much of the developing world welcomes the needed assistance.

This starkly contrasts with the haphazard response to the virus in the United States, its ban on exports of medical gear even to its closest ally Canada (which has since been lifted), and its animosity towards the WHO. At a time when the world is looking for leadership, the United States is absorbed in its domestic battles against the virus and follows an isolationist Make America Great Again (MAGA) ideology.

In the past, major crises such as World War I led to shifts in the international balance of power. Whether this time is different remains to be seen.