Ronald U. Mendoza is Dean and Professor of Economics at the Ateneo School of Government and a former UN senior economist. You may follow him on Twitter @ProfRUM. Leonardo M. Jaminola III is a Research Assistant at the Ateneo Policy Center. You may follow him on Twitter @JamWithLeo.

Ronald U. Mendoza is Dean and Professor of Economics at the Ateneo School of Government and a former UN senior economist. You may follow him on Twitter @ProfRUM. Leonardo M. Jaminola III is a Research Assistant at the Ateneo Policy Center. You may follow him on Twitter @JamWithLeo.

Some analysts say that there is a populist tsunami sweeping across the world right now. And this is not new—the Thaksins in Thailand, Chavez in Venezuela, and Erdogan in Turkey, among others, signaled its arrival in many developing countries many years ago. More recently, even the industrialized economies were not spared, with the election of President Donald Trump in the United States and the Brexit vote in the United Kingdom. Some would argue that President Xi Jinping in China and President Rodrigo Duterte in the Philippines could also be considered populist leaders.

While there are several conceptions of populism, there are at least two ways to describe this phenomenon. One approach, popular in political science, describes populism as an ideology separating society into two antagonistic groups—the vast majority of people that usually includes the poor and low income groups on the one hand, and a corrupt elite from among the richest in society on the other. Among the economists, populism has sometimes been described as an economic strategy emphasizing redistribution, with rising risks linked to higher inflation and deficits later on. Populism is often seen as an unsustainable strategy, as growth eventually sputters and the costs associated with populist policies lead to debt-related challenges.

Populist waves often end in economic crises, as redistribution policies appealing to large numbers of citizens in many instances impose unsustainable fiscal burdens. In the worst cases, redistribution policies also often come at the cost of deep structural reforms, including those that make the economy much more competitive and inclusive. Deeper reforms are often delayed by temporary and shallow redistribution policies, while the country lingers in a populist euphoria.

In today’s world, populist leaders could come from the political left or the conservative right, frequently leveraging social discontent, as well as either racial or economic anxieties that are brewing in society. They may also at times leverage deep social, political, and economic divides in society, separating a large mass of voters from an elite, portrayed to be unnecessarily and unfairly advantaged.

Mixed Picture

In the Philippines, it seems that a mix of factors could be contributing to the tendency towards populist politics. One of these factors could be the rising inequality, which seems to favor a “high-output Philippines” that have probably benefited more from greater economic integration in the last several decades. This is consistent with the 2018 findings of Thomas Piketty that the recent rise of populists can be seen as a failure of major political parties to address inequality. With that in mind, pockets of marginalized communities and sectors find no voice in traditional political parties and so sought alternative politicians.

On the other hand, sectors which may have benefited less—or may even have been harmed—could then be targeted for redistributive policies: farmers with no means to invest in irrigation, young people aspiring for better jobs through higher education, small firms marginalized by the formal financial sector despite the benign credit environment, and an urban lower middle class, feeling the pinch from rising transport, housing, food, and other costs, combined with job uncertainty. Top this off with an urban population that witnesses the proliferation of rapidly improving lifestyles, and the mushrooming of high-end condominiums, and you have the makings of deep discontent—an “in-your-face inequality” that will likely generate growing pressure for a pushback.

In urban areas, growing concerns over the challenges and risks associated with rapid urbanization—including the threat of crime and illegal drugs, rising transport costs and traffic, as well as economic uncertainty—could also be contributing to the strong support for policies that cater specifically to these issues. That in itself does not necessarily make those policies populist—rather it is the focus on quicker yet ultimately unsustainable policy shortcuts, which may give rise to the canonical populism that has led to policy failure and crises in many countries where this has taken hold.

However, economic inequality is just half of the story. Riddled with political dynasties, a particular form of political inequality has also emerged in the Philippines—inequality in access to power. Research conducted by the Ateneo Policy Center shows that the share of fat dynasties (i.e. families with two or more members in elected office) has grown from 19 percent of all local positions in 1988 to 29 percent in 2019. This concentration of power in the hands of a few families has been found to have detrimental effects on development.

In what follows, an analysis of three examples of Duterte policies paints a mixed picture as regards the claim to populism. The analysis focuses on the President’s vocal stance against oligarchs, the policies to support free irrigation, and finally the government’s tax reform program. These examples suggest that there is a high degree of incoherence and inconsistency in Duterte’s brand of populism.

Anti-Oligarch?

The uber-rich are an attractive target for populists, who often brand them as “oligarchs.” Similarly, President Duterte vowed to destroy oligarchs within weeks of assuming office. However, the difference lies in the inconsistency between the president’s rhetoric and policy actions as our example later clarifies.

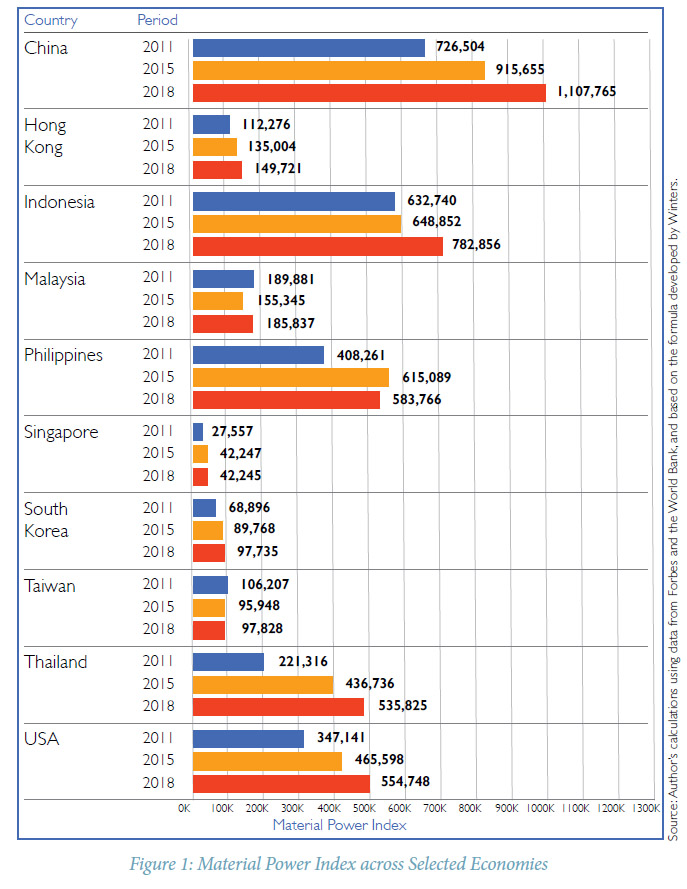

Yet first, one indicator in measuring the dominance (or potential dominance) of oligarchs in an economy is the material power index (see Figure 1). Developed by political scientist Jeffrey Winters, this index measures the gap in material resources between the oligarchs and the ordinary citizens by obtaining the ratio of the average wealth of the top 40 richest individuals to the GDP per capita of the country. One must note that wealth and GDP per capita are not exactly the same type of indicator—but the ratio nevertheless can be a useful bellwether of the gap between rich and poor. (In fact, measures of wealth tend to be larger than measures of income).

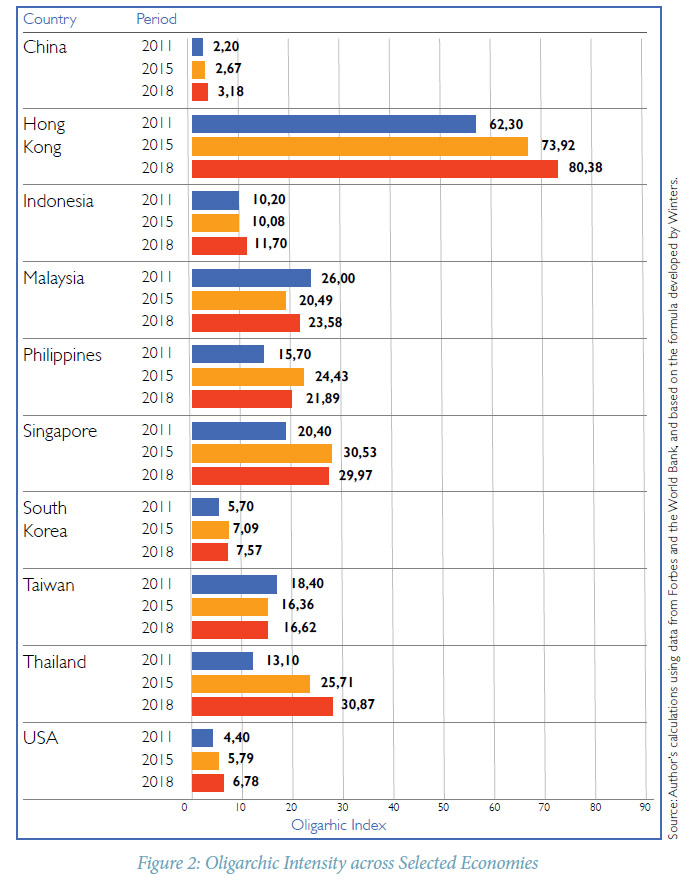

Furthermore, Figure 2 provides a snapshot of “oligarchic intensity” as measured by the total wealth of the top 40 wealthiest individuals in each of the selected economies, expressed as a share of total GDP.

Between 2011 and 2015, most countries in the sample experienced an increase in both oligarchic intensity and the material power index, suggesting increasing wealth (relative to the overall economy) among a very small group of individuals. This trend continues in 2018 as the material power index and oligarchic intensity of most countries in the sample continued to increase.

In 2015, the Philippines had a dramatic increase in its material power index. Put differently, the country’s top 40 richest individuals experienced a phenomenal increase in wealth over the past five years—growth outpacing the average Filipino income. Duterte’s tirades against the oligarchs seemed ineffective in light of recent figures—in 2018, almost halfway into Duterte’s term, both the material power index and oligarchic intensity declined only very slightly. The wealth of the top 40 richest individuals constituted more than a fifth of (20.40 percent) of the country’s GDP. Moreover, the Duterte Administration is also pushing for the second package of tax reform that is expected to generate a windfall for the country’s top conglomerates. It is possible that this may further exacerbate the distance in wealth between the richest and the poorest.

A more specific case further casts doubt on President Duterte’s anti-oligarch stance. Early in his term, he singled out Roberto Ongpin as an oligarch that he hopes to take on. He then emphasized specific problematic characteristics of oligarchs—they obtain lucrative government contracts using political connections, and they engage in illegal activities to gain advantage, such as insider trading. A patrimonial state and a predatory oligarchy combine to extract rent for selected powerful vested interests, often to the detriment of public policy goals and the common good. Scholars of Asian industrialization have since called this either “booty capitalism” or “crony capitalism.”

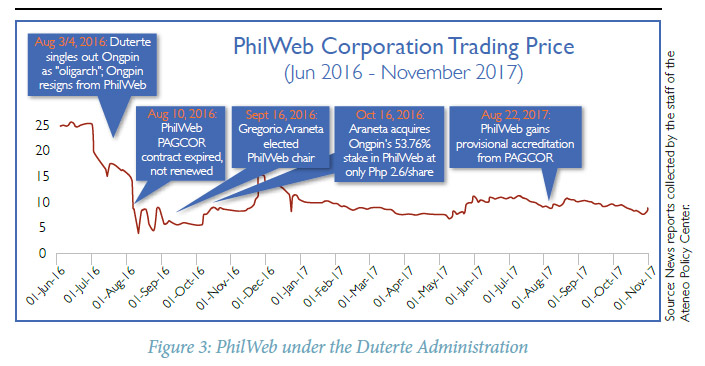

Following the president’s comments against Ongpin and the ills of online gambling, the shares of PhilWeb Corporation (Ongpin’s company) plunged, resulting in paper losses reaching at least PhP14 billion. Figure 3 juxtaposes the trading price of PhilWeb Corporation from June 2016 to November 2017.

Essentially, the pressure exerted by the President’s public comments combined with the non-renewal of PhilWeb’s contract by the Philippine Amusement and Gaming Corporation (PAGCOR) influenced the stock price to plunge by almost 90 percent. Ongpin then resigned; and Gregorio Araneta was elected the new chair of PhilWeb. (Note that Araneta also belongs to one of the wealthiest families in the Philippines; and he is also very politically connected, being the son-in-law of Ferdinand and Imelda Marcos and the husband of Irene Marcos.) Araneta then acquired Ongpin’s shares for a song at PhP 2.6 per share. PhilWeb subsequently gained provisional accreditation from PAGCOR, and its stock price recovered—translating to at least roughly PhP5 billion in gains for Araneta since he purchased the controlling stake in PhilWeb.

The PhilWeb saga may have exposed the true nature of Duterte’s rant against oligarchs—addressing very little by way of eroding oligarchic control of markets, while simply transferring economic rents from one wealthy clan to another.

Free Irrigation and Rice Tariffication

The cases of irrigation and rice tariffication further shed light on Duterte’s so-called populism. Access to irrigation remains one of the main challenges of agriculture in the Philippines. With the country having one of the highest irrigation fees in Asia, irrigation continues to be a burden for farmers. With this, President Rodrigo Duterte advocated for free irrigation (along with land distribution) during the campaign period.

In an attempt to fulfill this campaign promise, PhP 2.3 billion was added to the budget of the National Irrigation Administration (NIA) to cover the irrigation services fees (ISF), which used to be paid by farmers, increasing the total budget to PhP 38.7 billion. But is this enough to provide free irrigation for all?

According to NIA’s Annual Report, a total of PhP 1,671,729,887 was allocated for ISF in 2015. From this, it would seem that the additional PhP 2.3 billion is already enough to cover the ISF. However, according to NIA, the total firmed-up service area (FUSA) or the service area to be covered by irrigation facilities as of December 2015 is 1.7 million hectares, covering only about 57 percent of irrigable land. Of the remaining 1.3 million hectares, NIA is targeting to cover 75 percent over a 10-year period, which is 96,636 hectares per year. Moreover, of the total FUSA, there are still about 400,000 hectares left that need repair.

Based on the available figures, estimates were made with regards to the true total cost of irrigation, if all irrigable land were to be included. The results suggest that the government will have to pay a total of PhP 3.8 billion every year to cover the ISF of the entire 3 million hectares. Compare this with the present allocation of PhP 2.3 billion.

In addition, the above computation has not yet accounted for the cost of expanding the FUSA. Unless the government builds the necessary infrastructure, it will remain a challenge to bring water to farmlands. According to a study of the Philippine Institute for Development Studies (PIDS) on irrigation development, NIA in 1995 estimated the average cost per hectare of constructing a gravity irrigation system to be PhP 100,000. Note, however, that this is still underestimated if we are to consider the current cost. The computation in the table below illustrates the estimated cost to be incurred in constructing the additional target irrigation systems.

Adding 96,636 hectares per year to the FUSA thus costs an additional PhP 9.6 billion per year, in 1995 prices. In comparison, the NIA budget in 2017 increased only by PhP 3.6 billion from the 2016 budget. In other words, the increase in budget from 2016 to 2017 would have had to be more than doubled for the government to reach its stated target.

In summary, implementing a comprehensive program that will fully provide a free and sustainable irrigation system for Filipino farmers will require a much more extensive effort to repair and expand the existing system, as well as the mobilization of sufficient resources to bear the burden of such investments. The Duterte Administration’s quick fix on the matter might actually distract from these deeper structural issues.

Once again, the focus on “quick fixes” masks the lack of action on deeper structural reforms. Yet for many, this may actually be more palatable compared to the much slower pace of reforms (and impact) in relation to institutions and governance.

Furthermore, while vowing to support farmers and provide their needs such as irrigation, the Duterte Administration has been unable to provide safety nets for rice farmers during the rollout of the rice tariffication law. By August 2019, reports have shown that local rice farmers have been on the losing end of the implementation of the rice tariffication. On average, farmgate palay prices dropped to PhP 17 per kilo lower than the PhP 22 per kilo during the previous year. However, in some areas like Nueva Ecija and Pangasinan, the price of palay went down to as low as PhP 7 per kilo.

By pushing away from protectionism and flubbing the social protection of farmers, Duterte once again defies the typical conception of a populist leader.

Progressive Public Finance?

A focus on deeper reforms in the Philippines should inevitably tackle public finance issues—both on the taxing and spending sides of the public sector. The Duterte Administration recently passed the first installment of a comprehensive package of tax reforms (Tax Reforms for Acceleration and Inclusion Act or TRAIN) long advocated by many in the policymaking community.

There are a variety of motivations for various parts of the reforms—on top of fixing the progressivity and fairness of the income tax system and providing relief to the middle class, the government also seeks to generate over PhP 300 billion in new revenues to help fund its infrastructure program. In addition, concerns over the lack of competitiveness of Philippine tax rates abound, as the country’s corporate income taxes and personal income taxes (top tier) are among the highest in the region.

Finally, some tax policies (notably exemptions and lower rates) are used as a means to protect vulnerable members of society (e.g., the elderly and poor families), while others are used as part of the country’s efforts to boost investments and job creation in certain industries (e.g., business process outsourcing, industries in export processing zones, etc.). Nevertheless, there is evidence that the hodge-podge of fiscal incentives has created an incoherent fiscal environment whereby contradictory and ineffective policies fail to satisfy policy objectives.

Unsurprisingly, some of these goals are often conflicting in their expected impact. Increased revenues from indirect taxes are unlikely to reduce inequality. Removing VAT exemptions, while making the tool more efficient, will likely erode government support for key industries unless especially designed subsidies and support packages are ready.

As expected, the difficult trade-offs in the still-evolving tax package are generating mixed reviews from various

groups. Yet, Filipino legislators now have a genuine opportunity to form a coherent narrative on how taxing and spending policies could help promote more inclusive development, improving dramatically from what past administrations have been able to achieve.

Rather than simply focus on tax revenues and growth (through infrastructure spending), this administration can address deep-seated inequality in society and economy through tax and spending reforms combined. Nevertheless, the emerging versions of TRAIN pushed by the House of Representatives differ significantly from the version supported by the Senate.

Once again, the Duterte Administration’s purported populism becomes less compelling given that the primary beneficiaries from the tax program are actually from the mid- to higher-income levels. In related analyses, the Ateneo Policy Center has advocated to leverage tax policy reforms (TRAIN) within a broader portfolio of economic development reforms that build stronger inclusiveness in the country’s growth pattern. Notably, by linking the tax reforms to food security reforms, as the transition from quantitative restrictions to tariffs, will also generate

revenues that can be channeled to protect vulnerable groups.

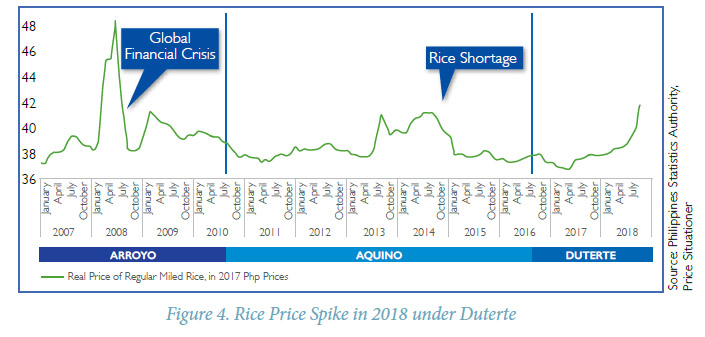

Moreover, TRAIN 1 had distributional impacts on the poor and low-income households as it raised the prices of certain commodities. The rollout of the tax reform coincided with the rice price spikes that further hurt the poor. Based on the 2015 Family Income and Expenditure Survey (FIES), the poorest 20 percent of Filipinos spent 19 percent of their budget on rice. To compare, rice spending of the 20 percent richest Filipino households only accounted 5 percent of their total budget. Clearly these examples paint a mixed image of populism under the Duterte Administration.

Incoherence

The three policy examples discussed in this article help to expose Duterte’s highly incoherent stance on populism. Taken together—and along with many other policy moves under Duterte—they reveal key divergences between rhetoric and action. They send mixed signals as to the true extent of redistribution or pro-poor stance that one normally associates with populism.

First, his anti-oligarch bark is worse than his bite. He does not really seem to be against oligarchy per se—and his actions on PhilWeb appear to have merely transferred economic rents from one business tycoon to another. Furthermore, the system of rent-seeking for government contracts—a structural challenge that has plagued the Philippine public sector for decades—has not really been debilitated in any institutional way.

Moreover, his stance on the agricultural sector—as evidenced by his rhetoric to make irrigation accessible and free—masks a disregard for the true extent of resource needs in the sector. It also exposes the lack of clear metrics to meet the true demand for support by this sector, implying that the impact of the “free irrigation” promise could be much more on the political sphere rather than on agricultural reality in the Philippines.

And the tax reform program of the Duterte Administration has created some benefits for the middle class workers; but it has led to more inflation pressure, in turn affecting many poor and low-income households. The latest national surveys by Pulse Asia (released in April 2018) note that about 86 percent of respondents reported being “strongly affected” by inflation in early 2018, with over 90 percent of respondents reporting food price increases, with rice price inflation topping the list of commodities most affecting them. Nevertheless, the tax reform program was well received by credit rating agencies and some investors. Most recently, Standard and Poors upgraded the country’s outlook to “positive,” taking note of the Philippines’ strong fiscal reforms so far. The enactment of the tax reform and the rice tariffication underlies a very conservative economic reform agenda. While the president continues to voice out populist rhetoric, his policy agenda tells a completely different story.

For these reasons, it is difficult to consider President Duterte a “populist” in this traditional redistributive sense. For instance, his administration’s controversial and bloody anti-drugs campaign has led to significant casualties among poor communities. Recently, there has been growing evidence of police abuse. Unsurprisingly, the slippage in his political support as evidenced by recent satisfaction surveys is among the poor and low-income groups, while his support among upper-income classes is holding steady. In the most recent Social Weathers Stations (SWS) survey released last April 2019, President Duterte recorded +58 percent in class E, dropping 7 points from +65 in the December 2018 survey. Meanwhile, the latest survey also showed that Duterte had a record-high score of +69 in class ABC, up by 7 points from +62 in December.

As regards his political style—which tends to be adversarial and divisive—it is also unclear as to what extent he favors the marginalized sectors of society (e.g., farmers, students, the poor). Some of the major reforms under his administration imply mixed effects on some of these groups. As shown in the analysis herein, promises may appear bigger than the actual program coverage and benefits that could be prudently absorbed by the public sector budget (as is the case in free irrigation); and reform benefits may not necessarily benefit the poor (as in the case of tax reforms). This carries political risk, if the President’s support base is eroded by a growing recognition that he may actually care less about poor and low-income Filipinos and he instead continues to behave unpredictably.

Reformists in the Duterte Administration could still implement a few reforms that could truly deliver for the vast majority of poor and low-income Filipinos. Clearly, one area would be to recalibrate the government’s bloody anti-drugs campaign, which has been focused on poor drug users for the most part while failing to address some of the main sources of the drugs problem. Drawing on international evidence and best practice, the government could instead implement a more health-based approach to curbing the drugs challenge in the country. A stronger partnership involving the Church, drug-affected communities, civil society and the Philippine National Police could help rebuild trust and address addiction challenges, notably among the youth. Drug supply interdiction focused on the sources of drugs could also help address the root causes of this problem in the Philippines.

In addition, the government’s tax reforms and infrastructure investments ramp-up are going to be good for economic growth. These will be even more impactful on the lives of more Filipinos if public sector investments go well beyond urban centers like Metro Manila and Metro Cebu. If these investments are more strategically developed, they could begin to better interconnect the sources of growth in the Philippines with more regions and populations that have not yet connected well with the country’s economic boom. In particular, the creation of “growth corridors” could dramatically increase the participation of many smaller firms, workers and communities in the country’s growth dynamic. By tapping more productive factors, this could also help to sustain the country’s industrial push, avoiding immediate inflationary pressure that would result from tapping only a limited pool of resources and regions.

Finally, addressing the country’s food security policy—in particular rice policy—could also help address hunger and poverty in dramatic ways. One way to dramatically reduce the number of hungry and poor families is to stabilize the price of rice at a much lower level than present. This is possible—and much more cost-effective for taxpayers—if a combination of increased importation and targeted agricultural investments for increased productivity and economic support for affected farmers could be designed as a package. Similar approaches already exist in the Association of Southeast Asian Nations—for example the Malaysians have a 65 percent rice self-production target, with the rest of their rice supply more competitively purchased from international markets. This support to farmers will boost productivity and prevent the firesale of agricultural land to developers. Moreover, such a reform could prove popular among poor and low-income households, for whom food constitutes a relatively larger share of the household budget. And it could also provide relief to many minimum wage and informal workers who may not have benefited from the tax reforms (principally because the poor in the Philippines are not covered by personal income taxes anyway).

There is still time to create real positive change in the lives of the vast majority of poor and low-income households in the Philippines. Beyond mere populist-sounding promises, deep structural reforms are necessary to help ensure more inclusive development and less socio-economic and political division in the Philippines.