Grover Norquist is President of Americans for Tax Reform, a taxpayer group he founded in 1985 at the request of President Ronald Reagan. Norquist chairs the Washington, DC-based “Wednesday Meeting”—a weekly gathering of more than 150 elected officials, political activists, and conservative movement leaders. There are now 50 similar center-right meetings in 42 U.S. states and 25 countries. You may follow him on Twitter @GroverNorquist.

IN the United States, Republicans and Democrats disagree on many issues. But not every issue divides along party lines. Some elected Democrats supported President George W. Bush’s wars in Afghanistan and Iraq. Some Republicans support legalized abortion. Some Democrats oppose gun control. But on the issue of taxation the two major political parties in the United States are internally united and in total opposition to each other. Every Republican will vote for tax cuts and against tax increases. Every Democrat will support tax increases and opposes tax reduction.

That was not always the case. In 1964, the tax cut proposed by President John F. Kennedy—to reduce personal and corporate income taxes across the board—was enacted with bipartisan support, but interestingly, “Mr. Conservative Republican” Senator Barry Goldwater voted “no.” In 1978, Republicans and Democrats joined to pass a cut in the capital gains tax over the objections of the Democrat president Jimmy Carter.

In 1981, 25 Democrats joined the Republicans in the Senate to pass the Reagan tax cuts that, like Kennedy’s legislation, reduced tax rates for all Americans. And in 1982 Democrats were joined by Republican Senate leader Bob Dole in demanding tax hikes to reduce the deficit and many Republicans in the House and Senate voted yes.

And in 1986, President Ronald Reagan and the Democrat-controlled House and Republican-controlled Senate enacted a revenue neutral tax bill that cut rates and eliminated many deductions and credits.

In short, taxes were cut with bipartisan support, taxes were raised with bipartisan

support, and taxes were dramatically reformed with bipartisan support.

That era is now over.

If Joe Biden is elected president with a Democrat House and Senate (today Democrats control the House and the Republicans control the Senate) taxes would increase by $4 trillion over the next decade—that’s $400 billion dollars a year. Biden has also endorsed spending plans of more than $11 trillion over the next decade.

Biden has repeatedly stated that he would repeal the entire Tax Cuts & Jobs Act—the $1.9 trillion tax cut Trump enacted with only Republican votes—“on Day One.” He threatens to impose or increase a host of other tax hikes, some of which are deliberately less clearly stated.

The Trump 2017 Tax Cut

Let’s first look at the Trump tax cut signed into law in December 2017. It shows Republican priorities that would likely be continued and deepened should Trump be re-elected with a Republican House and Senate. Conversely, by understanding the Trump tax cuts, we understand the size and structure of the tax increase Democrats would be enacting if, as promised, they repeal the Trump tax cuts.

Today, the U.S. federal government collects both a personal income tax and a corporate income tax. Both were reformed and reduced by the Trump tax cuts. For many years, however, the United States had neither a corporate nor personal income tax. A personal income tax was briefly imposed during the Civil War. After the war ended, the personal income tax was repealed.

In 1894 Congress voted to reestablish the personal income tax but in 1895 the Supreme Court ruled it was not allowed by the Constitution, which clearly and strictly limits the taxation powers of the national government. It required a constitutional amendment to give the federal government the power to tax incomes. Then Congress voted the specifics of the tax.

Let’s look first at the changes the Trump tax cut made to taxation of corporate income.

The American corporate tax rate was 35 percent when Trump was elected. The American tax rate on corporate income was the highest in the world. It damaged our ability to compete in the world market.

Compare the American 35 percent tax rate to China’s 25 percent, or the UK’s, which is set at 19 percent. Japan’s rate had been 40 percent a few years earlier, but was reduced to 23 percent.

The original goal of Congressional Republicans was to reduce the 35 percent corporate rate to 25 percent. Some Democrats had in the past said they would be willing to reduce the rate to 28 percent, but only if business taxes were increased elsewhere to make the change a tax hike.

During the 2016 presidential campaign, Trump endorsed the House Republican tax proposal but argued for a top corporate rate of 15 percent rather than 25 percent. House Republicans countered by moving their goal to 20 percent. All this before the election that brought Trump to power.

The final legislation moved the corporate rate from 35 percent—the highest in the world—to 21 percent, lower than most large economies and below the average for Europe. Still Ireland’s corporate rate remains at 12.5 percent, Hungary at 9 percent, and Canada at 15 percent.

Worldwide vs Territorial Taxation

The Trump tax cut also removed a second surprisingly anti-competitive tax policy—again, the first being the 35 percent rate that put America in the “worst in class” position—namely America’s worldwide system of taxation. Almost all other nations tax economic activity within their borders but not economic activity by their citizens or companies in other nations. Before the Trump tax cut, the profits earned by an American firm operating in France would first be taxed in France at French rates and then again when and if profits were repatriated back to the United States.

The Trump reform in essence moved the United States to a “territorial” tax system whereby American firms pay the full American corporate rate on earnings in the United States and are not double taxed on earnings overseas. And most of the earnings accumulated overseas over the years would be allowed to return without a penalty tax. When the bill passed there were more than $2 trillion in American corporate earnings “locked” overseas. Those earnings all became available to return to the United States penalty-free.

Unfortunately, while many in Congress wanted to treat the nine million Americans living abroad the same way we now treat U.S. companies—taxing only income earned in America and not levying U.S. federal taxes on earnings from abroad—that reform was not in the final package.

Republicans are determined to reform the personal income tax treatment of Americans working overseas in the next round of Republican tax reform.

Full Expensing and Personal Deductions

Some economists argue that the corporate tax rate cut—as powerful an engine of growth as it is—was not as important as moving from the depreciation of capital assets like factories, equipment, and machines to immediate expensing. This allows a company to buy a million-dollar machine and expense that capital investment today. The previous rule was that you could deduct $100,000 each year for ten years. The time value of money makes a million-dollar expense in year one much greater than the long, strung out deduction of the same million dollars over ten or twenty years.

Because of budget constraints (fear of deficits), Congress and the president limited the expensing rule to five years. Pro-growth economists and political leaders very much hope to extend expensing and to make it permanent.

Federal taxation of individuals’ incomes was also dramatically reduced by the Trump-Republican tax cuts.

The standard deduction, the amount of money an American can earn without paying any income tax was increased from $6,000 for an individual to $12,000 and for a married couple from $12,000 to $24,000. This was a significant tax cut for individuals and families, and it greatly simplified the tax code. In the past one had to keep all receipts in order to claim deductions. Now over 85 percent of households use the new higher standard deduction and need not file all that paperwork.

Personal tax rates for Americans in all seven tax brackets were reduced and the top income tax rate was reduced from 39.6 percent to 37 percent.

Before the Trump tax cut, parents received a tax credit: a direct reduction in taxes owed of $1,000 for each child under the age of 18. That tax credit was increased to $2,000 and expanded to parents with incomes up to $400,000 so that while only 22 million families received the child tax credits under President Barack Obama, now 37 million households received such tax credits. The tax code became much more family friendly.

Death Tax & Abolishing SALT

The death tax—the tax on homes, bank accounts, property, and stocks that you own when you die—was first imposed during the Civil War. It was then repealed only to be reimposed to pay for World War I. While 70 percent of Americans tell pollsters that they would like the death tax fully repealed it has been in place since World War I, disappearing for just one year as a result of the temporary George W. Bush tax cuts.

The Trump tax cut reduced the death tax imposed on one’s life savings at death. The amount of money one can leave for one’s children tax free was increased from $5.5 to $11 million.

One economically and politically significant change was to end the tax deductibility of state and local taxes (SALT). Before the Trump tax cuts, a taxpayer in a very high tax city, say New York City, in a very high tax state, namely New York, could deduct his state income taxes and his city property taxes from his taxable income. With a top federal income tax rate of 39.6 percent, this meant that high state and local taxes appeared less painful. Since the federal government was going to seize almost 40 percent of your earnings anyway, if the state and local government took a big bite, your actual cost of high state and local taxes was reduced by the 40 percent you would have lost anyway. It was a subsidy for high taxes on high income tax earners.

This change raises about $60 billion a year and was largely paid by high income earners in Democrat-controlled states and cities. Even before this change, there had been a noticeable emigration away from high “tax and spend” states—usually controlled by Democrats—such as New York, California, and New Jersey and towards low tax states like Texas, Florida, and Tennessee. In 2016, for example, 600,000 Americans moved from the highest taxed states to the lowest taxed states.

Nine states have no state income tax. They are: Florida, Tennessee, Texas, South Dakota, Alaska, Wyoming, Oregon, New Hampshire, and Nevada. Eliminating the tax deductibility of state income taxes in calculating taxable income at the federal level has no effect on those states. But taxpayers in expensive cities in high tax states—e.g. San Francisco and New York City—saw some of the tax cut they received in the total tax reform legislation clawed back by the elimination of the deductibility of State and Local Taxes.

The state governors of New York and New Jersey have decried the increase in wealthy citizens leaving their states and denying their states the tax revenue they once were willing to pay. Joe Biden, whose political support comes from large and highly taxed cities in deep Blue (Democrat) states has said that he plans to restore that deductibility. This reform not only raised money to “pay for” rate reductions, but is a powerful force limiting the ability of mayors and governors from raising taxes on high income earners because they now feel every penny of any tax hike. And with months of the COVID-19 shutdown in 2020, such taxpayers have found that they can work at home from any state—perhaps one with no income tax.

Obamacare and Trickle-down Taxation

In 2009, the Obama Administration wanted to force everyone into their health care plan known as “Obamacare.” It was not clear that the Constitution allowed the federal government to impose such a mandate so they put a tax, a penalty, on those who did not choose to buy the government’s offered health care.

The plan was not a good deal for millions of Americans. It was expensive. To force citizens to join Obamacare they imposed an Obamacare tax penalty of $695 per person. Or $2,085 for a family of four. This tax hit 5 million Americans per year. Three quarters of them earned less than $50,000.

The Trump tax bill took this penalty to zero. Biden has at least twice now said before television cameras that he’d would reimpose that tax on middle-and lower- income citizens.

The Trump tax cut also eliminated most of the Alternative Minimum Tax (AMT). This was a tax enacted in 1969 supposedly targeting 155 Americans who paid little in taxes because they invested in tax-free municipal bonds. By 2000 the AMT was hitting 600,000 Americans. If it was not reduced it would have gone on to hit 30 million Americans by 2010. Now it is gone for all except 200,000 households.

The AMT is an example of “trickle down taxation.” Advocates of higher taxes demand a new tax because of an “emergency” (say a war or recession) and promise it will only hit “the rich.” You are supposed to believe this means, “not you.” Then over time inflation pushes more and more Americans into the target zone of being “rich.”

In 1898 Congress passed a tax on long distance phone bills. This at a time when few Americans had phones and long distance was a luxury. The reason: the war with Spain. So the tax was to be temporary—the war would end. And it was only on the few, the rich. But over time all Americans had phones and long-distance calls were common, not rare. And while the war ended, taxes on the rich spread out to everyone and lasted more than 100 years. The federal income tax began in 1916 with a top rate of 7 percent. Now the bottom rate is 10 percent. And now half of households pay federal income taxes.

The AMT was just another “tax the rich first” ploy, and Biden has promised to restore it.

Differing Explanations

So how will taxation play out in November’s presidential and congressional election? How do Trump and Biden explain the last four years?

The argument for Trump is that his tax cuts, deregulation measures, and judges who self-limit their power has led to higher wages, more jobs, and greater life savings for Americans.

The Obama/Biden recovery from July 2009 through the 2016 election was the weakest recovery since World War II. This is to be contrasted to Ronald Reagan’s recovery in jobs, income, gross national product, which was the strongest recovery.

On the day Trump defeated Hillary Clinton the economy reacted to the anticipated new Trump tax and regulatory policies. From Election Day in 2016 to the week COVID-19 hit in early 2020, the S&P 500 stock exchange rose 56 percent. Total employment rose by almost seven million. Unemployment fell from 4.7 percent to 3.5 percent.

Rebutting criticism from the Left: one notes that unemployment for black Americans hit a 50-year low of 5.8 percent. Hispanic unemployment fell to 3.9 percent and unemployment among women fell to 3.1 percent.

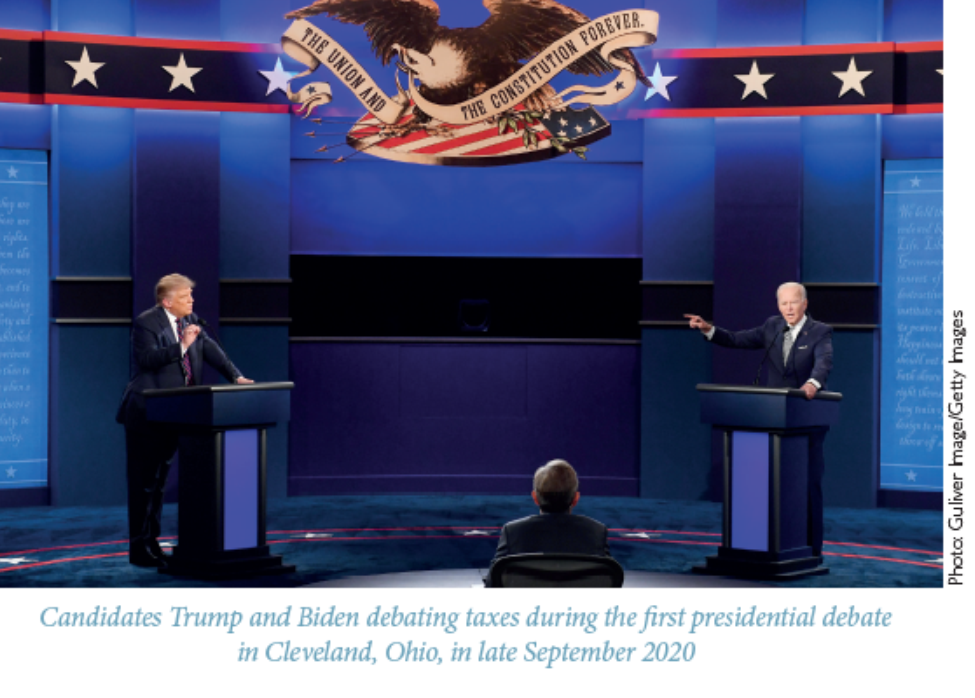

The median income for families grew by 6.8 percent from 2018 to 2019, the first year of the tax cut. That competes with only 5 percent growth in median income for the eight years of the Obama/Biden presidency.

Lowering Utility Prices & Job Creation

The corporate tax cut directly lowered utility bills paid by Americans. Electricity, water, and gas bills for households and businesses went down in all 50 states. Utility companies pay the corporate rate, and when the rate is reduced, the savings are passed along to consumers. Biden wants to raise the corporate tax, which would impose higher utility prices and hurt struggling households and small businesses operating on a tight margin.

The organization I lead, Americans for Tax Reform, has collected over 1,200 in-their-own words examples of good news arising from the Tax Cuts and Jobs Act. These are employers of all sizes around the country hiring new employees, raising employee pay, purchasing new equipment, and expanding operations.

Anfinson Farm Store in Cushing, Iowa—a century-old business—was able to give employees a $1,000 bonus and a 5 percent salary increase. Rockford Ball Screw in Illinois hired 25 new employees and expanded their facilities by 30,000 feet. Industrial Weldors & Machinists in Minnesota hired new employees and invested in employee pensions. Glier’s Meats in Kentucky increased employee wages, hire new employees, purchase new equipment, and increase employee benefit packages.

Although Americans do not often hear about it from the media, large corporations also increased pay and benefits. For example, Walmart and Lowes increased employee pay and bonuses but also created a $5,000 adoption benefit. For any employee incurring costs from an adoption, the companies will provide $5,000 to help cover the cost.

McDonald’s expanded a program to help 400,000 employees pay for college and trade school. For any employee working just 15 hours per week, the company will pay $2,500 toward tuition and educational expenses.

The tax cut package also reduced taxes on craft beer, wine, and spirits makers. This has furthered the American craft beverage renaissance as thousands of local facilities add new jobs and public social spaces in their communities.

For example, Sugarlands Distilling Company in Tennessee was able to build a large new distillery and barrel house, hire new employees and purchase $2 million of new equipment. Market Garden Brewery in Cleveland said the tax cuts caused “several million dollars of investment in our facility as well as the creation of a large number of full-time positions.” Alexander Valley Vineyards in California said the tax cuts caused “an incredible boost for our industry and this extension allows us to continue investing in our wineries by buying new equipment, remodeling tasting rooms, hiring new employees and more.”

Opportunity Zones

The tax cuts also created Opportunity Zones which provide capital gains tax relief for those who invest long term in economically distressed areas. Governors of each state were given the authority to designate the specific areas. The Zones are creating job and opportunities, revitalizing neighborhoods, and bringing much-needed services to communities.

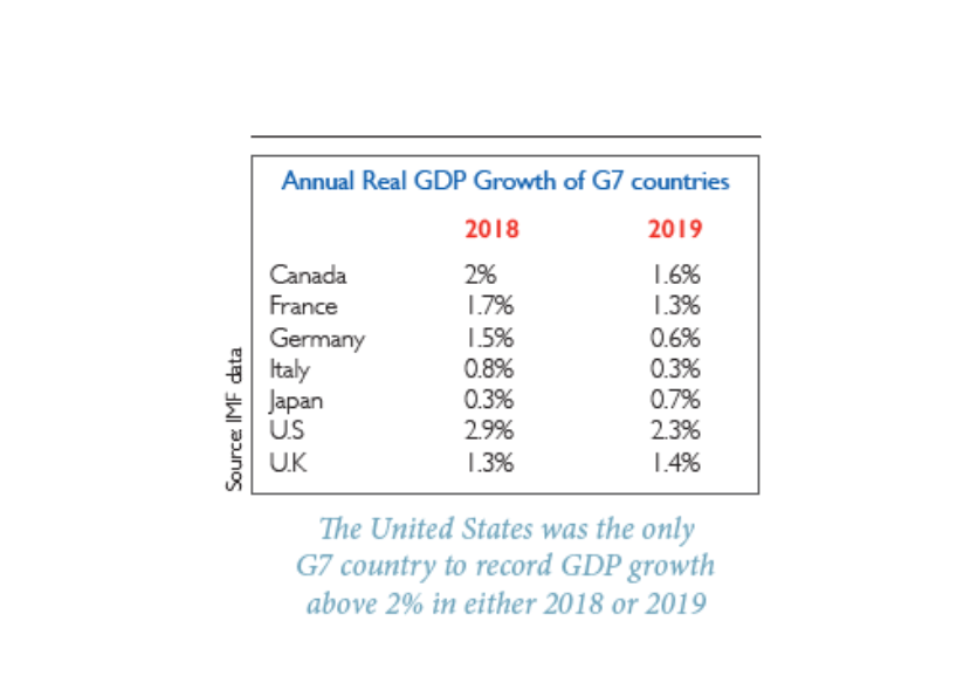

And the economic growth unleased by the tax reduction was not simply some worldwide period of growth. The chart below shows that the United States was the only nation to grow more than 2 percent a year in both 2018 and 2019.

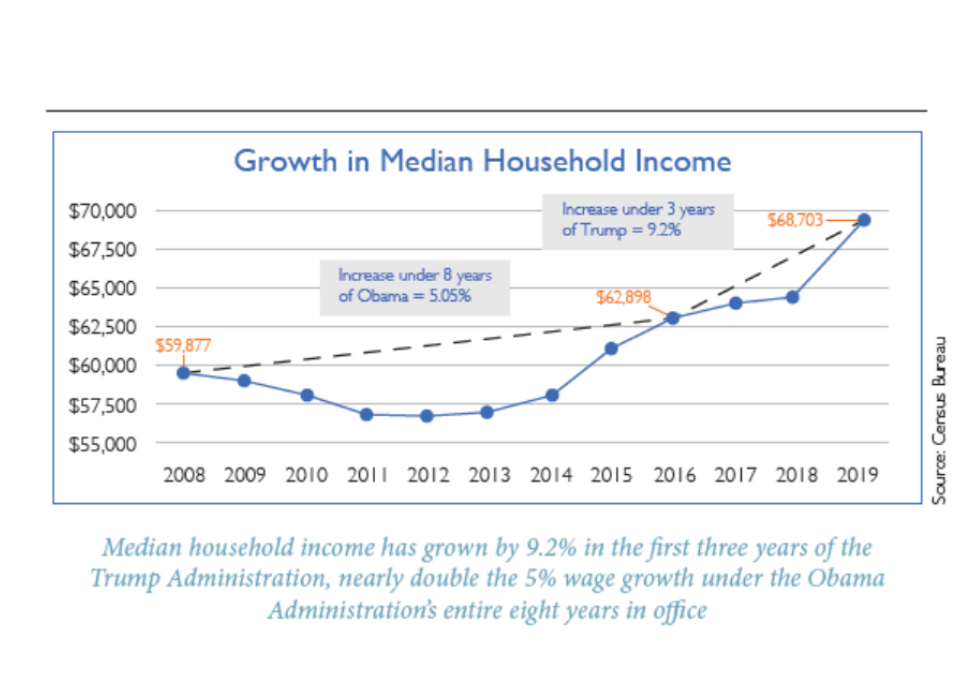

The media and left always say the tax cuts were for “the rich.” That was always false but now we have official IRS data to show middle income households received a bigger tax cut than “the rich” did. Americans with an income of $50,000 to $74,999 saw a 13.2 percent reduction in average tax liabilities between 2017 and 2018. Americans with an income of $1 million or above saw a 5.8 percent reduction in average federal tax liability between 2017 and 2018, less than half the tax cut seen by Americans making between $50,000 and $100,000.

When COVID-19 hit America 20 million jobs were lost and the stock market fell, but not as far down as when Obama and Biden were in charge of the U.S. economy. Thus the Trump campaign has pointed out that Biden was and would be worse for the health of the average American’s life savings than COVID-19. In less than six months, half of those jobs have been restored and the stock market is back close to its pre-pandemic heights.

It is interesting that polls (Rasmussen) show that 49 percent report that they are better off today than they were four years ago. An amazing number given that many states remain under partial lockdown in response to COVID-19. The underlying strength of the American economy is showing through the coronavirus fog.

The Biden argument is that the benefits of the tax cut went solely to the few rich: the so-called “one percent.” To do this he has to ignore the growth in jobs and income and the damage done by the COVID-19 lockdown.

Note that in the chart below that the bottom 25 percent of income earners saw their income increase more that the top 25 percent—reversing the Obama period when the rich gained more ground than the middle class.

Biden Tax Raise

Should Biden win and be joined by a Democrat-majority Congress and Senate, he has said that he would repeal the entire Trump tax cut “on day one.” What would that do? For the median income family of four earning $70,000 a year it would raise their taxes by $2,000 each year. For a single parent with one child, the tax hike would be $1,300. Five million Americans would be hit with the $695 per person Obamacare individual mandate tax.

Those are powerful numbers, but they miss something big that has changed. While the politics of envy and hatred towards the “one percent” may once have been good politics, there is today a new and awakened voting constituency: namely, those whose life savings are in a 401K, Individual Retirement Account, or defined contribution pension.

These savings vehicles were created in the 1970s and have grown from 19 million in 1990 to more than 100 million today. One hundred million adults in a nation with a total population of 330 million is not exactly the “one percent.” But every tax hike proposed by Biden would reduce the value of Americans’ life savings. Every regulation hurts the average American’s IRA or 401K.

Those 100 million Americans know how much their life savings have increased since Trump became president. They know how their savings fell in value at the start of COVID-19, and now how they have already rebounded. The Trump campaign’s goal is to highlight this progress and make it clear it will be taken away by a Biden presidency.

Simply put, the emerging investor class—“the 401K vote”—is the antidote or vaccine against the virus of the politics of envy.

Now, Biden has said that he would never raise any tax on any American earning less than $400,000. But this means less than he tries to convey. He views all taxes on corporations as being paid for by “the rich,” although we have seen how 100 million Americans and their families would be damaged as their life savings in a 401K would decline.

And Biden pretends that a carbon tax or tax on energy would somehow be paid by oil companies rather than by every American who fills up his gas tank, buys home heating oil for the winter, and electricity for air conditioning in the summer.

But there is another reason we know he has no intention of protecting Americans earning less than $400,000. He has played this game before. He told the same lie in 2008 when with Obama he promised he would never raise any tax on anyone earning less than $250,000. He then went on to create the Obamacare individual mandate tax on lower income Americans, and a series of such taxes to pay for Obamacare on the backs of the middle class.

And one need only to look at Europe with its draconian energy taxes to see what happens to the cost of gasoline for cars, energy for manufacturing plants, and transportation costs. Any broad-based energy tax in the United States is understood to be the first step towards a Value Added Tax, which falls heavily on middle- and lower-income taxpayers. Two sayings in the U.S. make the point: “VAT is a French word for big government;” and “a carbon tax is a VAT on training wheels.”

Three Possible Outcomes

There are three possible outcomes for the day after the November 2020 elections. They are, one: Trump wins re-election with a Republican House and Senate; two: Biden wins the White House with a Democrat-majority House and Senate; or three: divided government, with no party controlling the White House and both houses of Congress.

With regards to the first, the relevant comment is that a Republican Senate would put American back on track to continue the work of the 2017 tax cut. The personal income tax cuts that were passed have a ten-year expiration date. Those tax cuts would be made permanent. Congress will end the double taxation of Americans living abroad. There will be no energy tax imposed. Capital gains taxes would be indexed such that the increased value in a house, stock, or land attributable to inflation would not be taxes. Only real gains would be taxed. For stocks that would translate to a 40 percent cut in the capital gains tax rate. And the expensing of new investment would be extended and/or made permanent. Some Republicans have called for enacting a zero capital gains tax rate for any strategic minerals stored in the continental United States.

A Democrat sweep—the second possible outcome—would end the Trump tax cuts and impose across the board tax increases. It would add an energy tax atop everything else. Biden has made private promises to the “Green New Deal” advocates that he refuses to discuss publicly. Taxes on air travel? A tax on stock transfers? Higher death taxes?

Divided government—the third possible outcome—would mean no tax hike or tax cut for the next two to four years. There would be great pressure against new spending. During the Obama years spending fell from 24 percent of GDP to 20 percent of GDP as Republicans who had signed the Taxpayer Protection Pledge, a written commitment to oppose and vote against any tax hike. Republicans held their ground and stopped any tax hike and Obama had to give up on $2 trillion in spending he had wished to impose. If Republicans hold 51 Senate seats, they would be able to stop the Democrats from stacking the Supreme Court by adding more members and stop the Democrats from adding new Democrat Senators by turning the federal district of Washington D.C. into a state. Then the contest continues in 2022 and 2024.