Jin Canrong is Distinguished Professor at Renmin University of China’s School of International Studies and a holder of the state-honored “Chang Jiang Scholar” title.

Jin Canrong is Distinguished Professor at Renmin University of China’s School of International Studies and a holder of the state-honored “Chang Jiang Scholar” title.

Yao Rukun is a Lecturer at the Department of International Relations and World Political Parties of the Party School of the Beijing Municipal Committee.

Yao Rukun is a Lecturer at the Department of International Relations and World Political Parties of the Party School of the Beijing Municipal Committee.

The Asia-Pacific region is undergoing a historic transformation, evolving from the concept of the “Asia-Pacific Century” to that of the “Greater Asia-Pacific,” signifying the shift of global economic and geopolitical centers. In this vast area, which encompasses North America, Australia, and most of Asia, the competition and cooperation between China and the United States are profoundly shaping the region’s future. As the most significant strategic contradiction in the Asia-Pacific, the evolution of the Sino-American relationship will determine whether the region can sustain its vitality and achieve long-term development. This article attempts to systematically review the definition and significance of the “Asia-Pacific Century,” analyze the historical turning points and current competitive dynamics of the China-U.S. relationship, and explore the impact of three possible future trajectories of this relationship on the Asia-Pacific landscape.

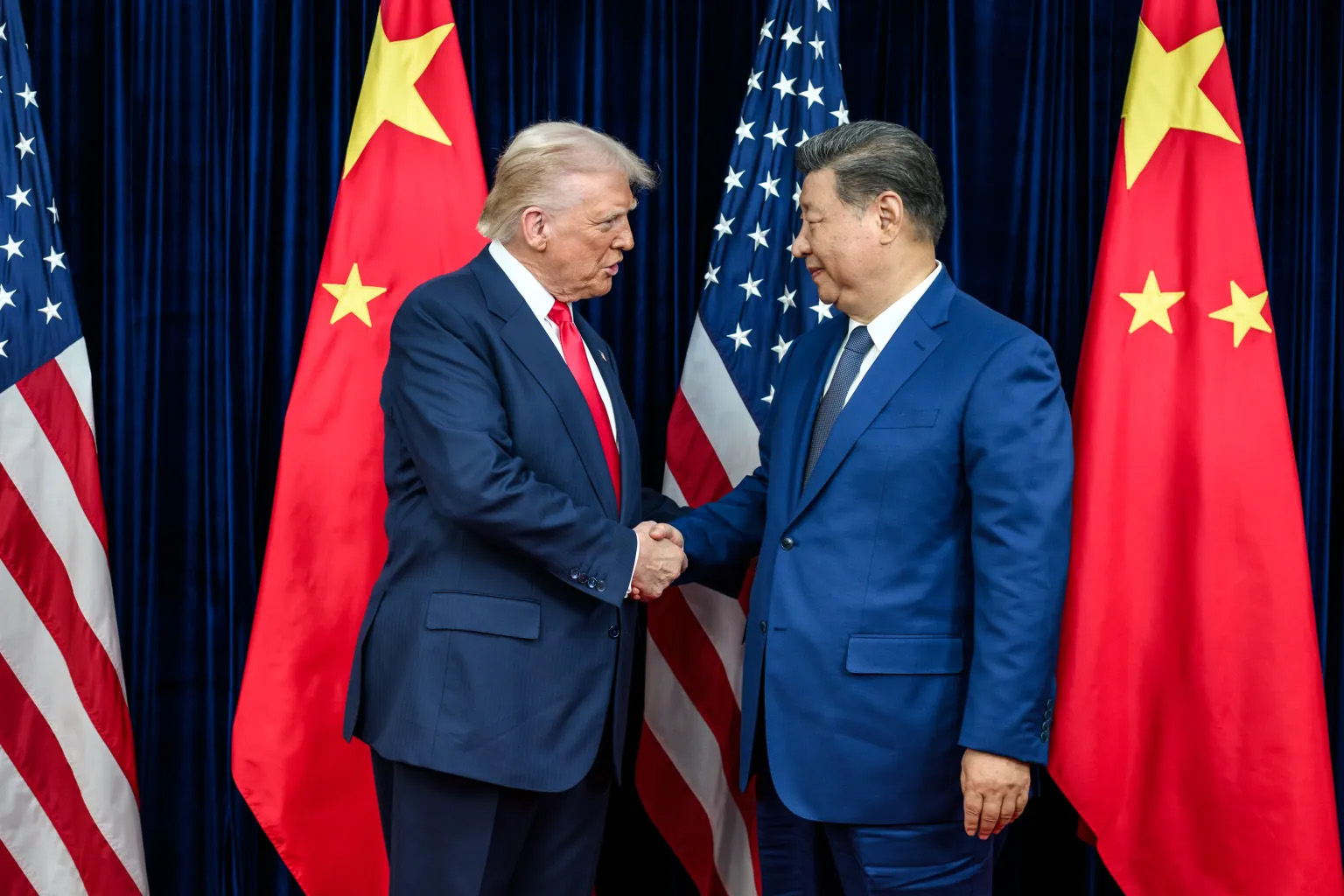

Presidents Xi Jinping and Donald Trump meet in Busan, South Korea on October 30th, 2025 | Source: whitehouse.gov

The Evolution of the Asia-Pacific Century Concept

“The Asia-Pacific Century” is a geopolitical concept first proposed in the late 1980s, referring to the expectation that the Asia-Pacific region would come to dominate global politics and economics. The idea was first advanced by former Japanese Prime Minister Nakasone Kakuho in 1985, who believed the region would become the center of global affairs. With the rise of the Japanese economy, the rapid development of the “Four Asian Tigers,” and the shift of the U.S. economic center from the East Coast to California on the Pacific coast, the notion of the “Asia-Pacific Century” quickly gained prominence.

When the first Trump administration introduced the 2017 Indo-Pacific Strategy, also known as the “Free and Open Indo-Pacific” concept in the United States, this marked another turning point in the region’s landscape. One of the strategy’s important objectives was to incorporate India—an emerging major power—into the geopolitical framework of the Asia-Pacific, thereby forming a more dynamic concept of the “Greater Asia-Pacific.” This expanded region includes North America, Australia, and most of Asia (excluding the Middle East and West Asia), with a GDP accounting for over 75 percent of the world’s total and trade volume reaching over 73 percent, making it the most dynamic growth belt in the global economy.

The importance and uniqueness of the Asia-Pacific region are reflected in the following three dimensions:

Economic power. The Asia-Pacific hosts the world’s major economies, including China, the United States, Japan, and India, whose combined output accounts for over 40 percent of global GDP. Initiatives such as the Belt and Road and the signing of the Regional Comprehensive Economic Partnership (RCEP) have further strengthened economic integration and regional cooperation.

Geopolitical status. The region is home to the world’s leading military powers—the United States, China, and Russia—all maintaining significant military presence. It is also the most active diplomatic stage globally, with multilateral mechanisms such as Asia-Pacific Economic Cooperation (APEC), the ASEAN Regional Forum, and the Shanghai Cooperation Organization (SCO) intersecting here.

Contradictions and vitality. The Asia-Pacific is marked by both major power rivalries, such as U.S.-China strategic competition and disputes in the South China Sea, and complex issues including religious and cultural differences. This coexistence of contradictions and vitality increases the difficulty of international governance but also provides broad opportunities for regional cooperation.

Historical Turning Points of Sino-U.S. Relations

Among the many relationships in the Asia-Pacific region, the one between China and the United States plays a decisive role. Shifts in this relationship directly affect the fate and future of the entire region. Historically, U.S.-China relations can be divided into two distinct stages.

In February 1972, U.S. President Richard Nixon’s visit to China marked the beginning of the normalization of Sino-American relations. Over the next 45 years, despite differences and occasional frictions, the overall tone was one of constructive cooperation, and the relationship remained on a stable track. Key examples of cooperation during this period include: China’s official accession to APEC in 1991, which promoted regional economic integration; China’s stable economic growth during the 2008 financial crisis, which contributed to global recovery; the 2014 Beijing APEC meeting, which approved the roadmap for the Asia-Pacific Free Trade Area and reached consensus on economic innovation and development; and the 2015 joint statement on climate change, in which China and the United States demonstrated the responsibility of major powers in addressing global challenges.

On December 18th, 2017, the Trump administration released its first National Security Strategy Report, designating China as a “strategic competitor.” This marked the beginning of a new phase of comprehensive competition in U.S.-China relations. Since then, several turning points have further strained ties: in March 2018, the United States initiated a trade war against China, imposing tariffs on approximately $50 billion worth of Chinese goods, to which China responded with its own countermeasures. In May 2019, the United States added Huawei and 70 of its affiliates to the “Entity List,” cutting off technological cooperation with American companies. And in August 2022, in her capacity as Speaker of the U.S. House of Representatives, Nancy Pelosi visited Taiwan, which triggered a military standoff, further eroding strategic trust.

Today, U.S.-China relations are largely defined by competition. Although China’s President Xi Jinping and U.S. President Donald Trump met in Busan, South Korea in October 2025 and agreed to enhance cooperation in areas such as trade and energy, the United States has continued to employ various strategic pressure tools, including Section 301 investigations (relating to denial or violation of U.S. rights in any trade agreement). This has only reaffirmed Washington’s competitive posture toward China.

This competition is taking place across three main dimensions:

First, domestic governance. Both countries are strengthening internal governance to address economic, political, and social challenges. China has expanded its domestic consumption market through the “internal circulation” strategy, which contributed 111.4 percent to GDP growth in 2023 and maintained a high level of 53.5 percent in the first three quarters of 2025. At the same time, China is actively promoting new energy development. In the first three quarters of 2024, China’s imports and exports with other Asia-Pacific economies increased by 2 percent year-on-year, reaching 19.41 trillion yuan. The United States, through initiatives such as the “Chips and Science Act” and the “Inflation Reduction Act,” has sought to revive manufacturing and promote technological innovation. However, in January 2025, Trump suspended IRA funding expenditures, raising questions about the continuity of the policy.

Second, competition in emerging productive forces. The rivalry in fields such as artificial intelligence, life sciences, and semiconductors is intensifying. In AI, the United States holds a clear advantage in computing power: as of August 2025, it accounted for 68.9 percent of the global market, compared to China’s 14.5 percent. American companies like NVIDIA dominate the AI chip market with a 92 percent share. China leads in the number of AI patents, generating 38,210 in 2023—six times more than the United States. In semiconductors, U.S. restrictions on China’s access to advanced manufacturing equipment, such as EUV lithography machines, have hindered Semiconductor Manufacturing International Corporation’s (SMIC) production of 14nm and below. The United States also revoked the VEU qualifications of Samsung and SK Hynix for their chip factories in China, further tightening the flow of semiconductor technology. In life sciences, the United States maintains a lead in technologies such as mRNA vaccines, while China continues to increase R&D investment in areas like gene editing and biomedicine.

Third, competition in building “friend circles.” Both countries are actively pursuing regional cooperation mechanisms to expand their influence. China has deepened cooperation with ASEAN through RCEP, with trade volume between China and ASEAN reaching $980 billion in 2024. It also continues to advance the “Belt and Road Initiative,” signing cooperation documents with 152 countries and 32 international organizations. The United States has sought to build alliances through the Indo-Pacific Economic Framework for Prosperity (IPEF), though its supply chain agreement attracted only six participants, and the QUAD has made limited progress in infrastructure. Meanwhile, Washington has encouraged allies such as Japan and South Korea to strengthen ties with ASEAN. Japan, through the “Government Security Capacity Enhancement Support” (OSA) framework, has provided coastal surveillance radars and communication equipment to the Philippines and Malaysia, and plans to offer high-speed security boats to Indonesia for free.

The Future of China-U.S. Relations

In the face of the current situation of full-blown competition between China and the United States, several possible future trajectories can be envisioned.

-

Parallel Market Establishment

The United States has built markets centered on its own economy, creating two parallel but not entirely isolated systems. Washington continues to pursue decoupling and severing links, while China accelerates the construction of independently controllable industrial and supply chains.

Impact on the Asia-Pacific Region:

Economic Fragmentation. The IMF predicts that a complete decoupling of the Chinese and American economies would reduce global output by approximately 1.5 to 2 percent, with losses in the Asia-Pacific exceeding 3 percent. China depends on the United States for about 16 percent of its exports, while 30 percent of U.S. consumer goods rely on Chinese production. Decoupling could lead to as much as a 3.5 percent GDP decline for both sides.

Supply Chain Restructuring. ASEAN countries will oscillate strategically between Chinese and U.S. supply chains. For instance, Vietnam’s trade dependence on China is 30 percent, yet it also participates in the IPEF. Japan has actively promoted supply chain transfers to ASEAN, investing $300 million to support 92 enterprises in relocating or expanding production.

Technical Standard Differentiation. Competition between U.S.-promoted chip standards and China’s 5G standards will create barriers, deepening technological fragmentation. China leads in AI patents, while the United States retains advantages in computing power and commercialization.

Regional Cooperation Mechanisms. Rule competition between RCEP and IPEF will reshape Asia-Pacific trade. RCEP emphasizes openness and inclusiveness, whereas IPEF carries a distinct geopolitical orientation. Whether the two frameworks can coexist will influence the pace of regional integration.

-

Managing Differences, Engaging in Limited Cooperation

Through diplomatic communication and crisis management, both sides may keep disputes within bounds, avoiding a complete breakdown. In areas such as trade, climate change, and global public health, necessary cooperation could be maintained, which could restore relations to the competitive yet cooperative state seen before 2017.

Impact on the Asia-Pacific Region:

Economic Stability. Stable U.S.-China trade relations provide certainty and boost market confidence. Following the October 2025 Busan meeting between the two Presidents, bilateral economic issues returned to dialogue, strengthening global confidence.

Deeper Regional Cooperation. Coordination within multilateral frameworks like APEC could advance integration. With China set to host APEC in 2026, Sino-U.S. collaboration on building a Free Trade Area of the Asia-Pacific may gain momentum.

Resumption of Technological Cooperation. Renewal of the U.S.-China Science and Technology Agreement in January 2024 facilitated joint efforts in climate and energy, such as the “Folate Revolution” and the Daya Bay Reactor Neutrino Experiment. However, U.S. technology controls remain in place.

Geopolitical De-escalation. Continued restraint on sensitive issues like the South China Sea and Taiwan has helped avoid military conflict, providing relative stability. Although U.S. military activity in the South China Sea decreased in 2023 compared to 2021, its presence in key maritime areas continues to this day.

-

Escalation of Conflict and Prolonged Confrontation

Failure to manage core contradictions—such as the Taiwan issue—could lead to open confrontation and even military conflict, resulting in a prolonged adversarial situation.

Impact on the Asia-Pacific Region:

Increased Militarization. Military confrontation would intensify regional militarization, escalating tensions in the South China Sea and Taiwan Strait. In 2021, the United States deployed four carrier strike groups and conducted 13 transits, signaling heightened strategic activity.

Economic Shock. Conflict could trigger blockades at chokepoints like the Strait of Malacca, threatening global trade and supply chain security. The IMF warns that even short-term conflict could reduce global GDP by about 1 percent, with perhaps greater long-term impacts.

Forced Alignment. Asia-Pacific countries may be compelled to choose sides, undermining cooperation and integration. ASEAN nations’ “strategic hedging” would intensify—for example, Vietnam could accept Chinese investment while also participating in the IPEF.

Challenges to International Governance. Protracted confrontation would complicate governance, weakening mechanisms like APEC and posing additional obstacles to regional cooperation.

Future Prospects

The Asia-Pacific region, as a key center of the global economy and geopolitics, could have its future landscape profoundly influenced by the direction of the China-U.S. relationship. The nature of the Sino-American relationship has shifted from one primarily focused on cooperation to one dominated by competition. Still, competition does not necessarily lead to confrontation. Viewed through three dimensions of competitive dynamics, China and the United States can sustain rivalry while still leaving room for cooperation, particularly in addressing global challenges such as climate change and public health. As an important economy and a promoter of regional cooperation in the Asia-Pacific, China must maintain its own development while actively advancing regional integration, and thus contributing to the stability and growth of both the Asia-Pacific region and the global economy.

At the same time, the United States must recognize that complete decoupling will not only fail to curb China’s rise but will also damage its own interests and slow the pace of global innovation. The future of the Asia-Pacific Century depends not only on whether China and the United States can find a constructive way to coexist, but also on the active participation and cooperation of other countries and regions in the Asia-Pacific. Only through dialogue rather than confrontation, and through cooperation rather than competition, can the Asia-Pacific region fully realize its potential as a global economic and political center and make greater contributions to world peace and development.