Peter Nolan is the Emeritus Chong Hua Professor in Chinese Development, an Emeritus Fellow of Jesus College at the University of Cambridge, and the Founding Director of the University’s Centre of Development Studies.

Peter Nolan is the Emeritus Chong Hua Professor in Chinese Development, an Emeritus Fellow of Jesus College at the University of Cambridge, and the Founding Director of the University’s Centre of Development Studies.

Over the long-run of human history since the Ancient World, there have been large shifts in the geographical location of technological innovation. Another large shift is under way. It has profound implications for international relations and global governance in the twenty-first century and beyond.

DeepSeek AI app on a smartphone with the founder of DeepSeek, Liang Wenfeng, in the background—both major headaches for U.S. tech giants | Source: Shutterstock

Innovation in the “Hydraulic Era”

For 2,000 years before the British Industrial Revolution, China’s “hydraulic civilization” was the world leader in technologies that harnessed water resources to support agriculture, transport, and industrial production.

Over the course of two millennia leading up to the Opium Wars, China was largely united and peaceful, governed by a meritocratic bureaucracy. The central duty of government officials was to care for the welfare of the population. Under bureaucratic rule, the Chinese state undertook key functions that the market failed to perform: ensuring peace and stability across its vast territory; stabilizing commodity prices; building and maintaining extensive water-conservation infrastructure; organizing famine relief; providing a legal framework within which a vibrant commercial economy could flourish; and disseminating best-practice knowledge through publications authored by officials.

The combination of the “invisible hand” of market competition with the “visible hand” of ethically guided state action fostered sustained innovation and technical progress. By the European Middle Ages, China’s technological level was far ahead of Europe. Chinese innovations made a fundamental contribution to European progress after the Renaissance. These included the maritime compass, watertight ship compartments, the sternpost rudder, paper, printing, porcelain, the blast furnace, canal lock-gates, gunpowder, and tubular metal weapons, as well as the crankshaft and the double-acting piston—the foundations of the steam engine. They also provided the basis for the European Military Revolution from 1500 to 1800, which had immense consequences for world history.

Innovation in the Fossil Fuel Era

Between the late eighteenth and the early twenty-first century, the world of innovation was “turned upside down.” The era of fossil fuels began with the invention of the steam engine in Britain in the late eighteenth century. Global consumption of fossil fuels (coal, oil, and gas) rose from 100 TWh in 1800 to 6,000 TWh in 1900, and reached 137,000 TWh in 2022. In the 1980s, the world economy entered a new phase of capitalist globalization, marked by revolutionary advances in information technology, widespread privatization, liberalization of international trade and investment flows, the opening of command economies, and comprehensive policy change in formerly “inward-looking” non-communist developing countries.

The “mainstream” view of the competitive process holds that the perfectly competitive model best captures the essence of capitalist competition. Mainstream economists generally argue that managerial diseconomies of scale set in once firms reach a certain size. Alfred Marshall compared the competitive process to “trees in the forest,” where the canopy never rises above a given height: “In almost every trade there is a constant rise and fall of large businesses, at any one moment some firms being in the ascending phase and others in the descending.” In The World Is Flat: A Brief History of the Twenty-first Century (2005), Thomas Friedman argued that the spread of global markets created unprecedented opportunities for firms from developing countries to “catch up” on the “global level playing field.” The world had become “flat” for individuals, countries, and firms from developing economies, thanks to liberalization, privatization, and the information technology revolution.

From the earliest stages of modern capitalism, a minority of economists have argued that it contains an inherent tendency toward industrial concentration. In Capital, Vol. 1 (1867), Karl Marx described a “law of centralization of capital”: “The battle of competition is fought by cheapening of commodities. The cheapness of commodities depends, other things being equal, on the productiveness of labour, and this again, on the scale of production. Therefore, the larger capitals beat the smaller.” In The Theory of the Growth of the Firm (1959), Edith Penrose concluded that there are no theoretical limits to firm size: “We have found nothing to prevent the indefinite expansion of firms as time passes…and there is no reason to assume that a firm would ever reach a size in which it has taken full advantage of economies [of scale].”

During the era of capitalist globalization, industrial concentration rose relentlessly alongside a huge increase in global output. By the early 2000s, within the high value-added, high-technology, and strongly branded segments of global markets, giant “systems integrator” firms controlled more than half of the global market.

These systems integrator firms, with enormous procurement expenditures, exerted fierce pressure on their supply chains to minimize costs and stimulate technical progress. Across the value chain, industrial concentration increased steadily, with a small number of firms accounting for a large share of the market in each segment.

The organization of the value chain evolved into a planned and coordinated activity. Systems integrator firms exercised tight control over the companies within their chains, both upstream and downstream. This represented a new form of “separation of ownership and control.” The boundaries of the firm became blurred, as the number of workers in the “external firm” typically far exceeded those employed directly by the systems integrator.

During the era of the global business revolution, systems integrator firms, closely coordinated with their supply chains, invested worldwide. They constructed business systems spanning both developed and developing countries. By 2021, the global stock of outward FDI had reached $42 trillion, with firms from developed economies accounting for more than four-fifths of the total. In other words, the global business system during the era of globalization was built primarily by firms from developed economies.

Since the 1980s, the West has reinforced its global technological leadership. In 2022, the top 2,500 firms (G2500) spent €1,250 billion on R&D, according to the 2023 EU Industrial R&D Investment Scoreboard. Apart from China, only 34 firms from low- and middle-income economies were included in the G2500, and not a single one ranked among the top 500. Within the G2500, the top 500 firms accounted for 80 percent of total R&D spending. In other words, just 500 firms—mostly from high-income economies—account for the vast majority of innovation and technical progress in the era of globalization.

Innovation in the Era of Electrification and IT

During the era of globalization, fierce oligopolistic competition produced unprecedented technological progress, bringing tremendous benefits to most people. Yet the era also brought about existential challenges for humanity: species extinction, environmental pollution, climate change, inequality in the distribution of income, wealth, and life opportunities, antimicrobial resistance, concentration of business power, and the growing influence of the financial sector over the real economy.

The compass guiding the “ship” of global innovation must change course, steered by the “visible hand” of government regulation, to secure a sustainable future for humanity. Electrification plays a central role in achieving sustainable development. Between 1990 and 2030, global electricity consumption is projected to increase more than threefold. The integration of electrification and information technology is crucial to overcoming the challenges facing humanity.

The ICT revolution has transformed the nature of innovation, the relationship of firms to their value chains, and the internal operations of companies. The pace of technical change within the ICT industry accelerated, culminating in the rapid development and application of artificial intelligence. The ICT industry has become the most important sector within global innovation. In 2022, the ICT sector (hardware plus software) accounted for 44 percent of total R&D spending by G2500 companies.

Global industrial consolidation in ICT has advanced rapidly, driven by the high levels of R&D investment required to compete in this sector. Within the G2500, the top 20 firms account for 68 percent of R&D investment in ICT hardware and 49 percent in ICT software. Industrial concentration is even higher in ICT sub-sectors. In smartphone operating systems, the top two firms (Google-Android and Apple-iOS) hold 85 percent of the market. In PC operating systems, two firms (Microsoft-Windows and Apple) control 89 percent. In browsers, the top two firms (Google-Chrome and Apple-Safari) have 82 percent. In search engines, a single firm (Google) commands 93 percent. In cloud infrastructure, three firms (Amazon-AWS, Microsoft-Azure, and Google-Cloud) account for 66 percent.

American firms dominate the sector. They account for 42 percent of R&D spending in ICT hardware and 70 percent in ICT software and services. In 2023, the top five ICT firms—all based in the United States—had a combined revenue of €1.43 trillion and combined R&D investment of €188 billion, representing 30 percent of total ICT investment by G2500 firms.

The sector is highly concentrated: the top ten semiconductor firms, all from high-income economies, account for around two-thirds of total sector revenue. Industrial concentration is even greater in specific sub-sectors. In EDA (Electronic Design Automation) software, three firms (Synopsys, Cadence, Siemens EDA) control over 70 percent of the global market. In 5G smartphone processors, the top two firms (Qualcomm and Apple) account for 60 percent of sector revenue. In PC microprocessors, the top two firms (Intel and AMD) hold 93 percent of the global market. In semiconductor equipment, the top four firms (Applied Materials, Lam, Tokyo Electron, ASML) account for 65 percent. In architecture design for smartphone processors, a single firm (ARM) has a near-monopoly. ASML alone controls 80 percent of the global market for extreme ultraviolet (EUV) semiconductor equipment. In GPUs for advanced AI, Nvidia commands 90 percent of the global market.

American firms dominate the most R&D-intensive segments of the semiconductor value chain. They account for 72 percent of value-added in EDA and core IP, 46 percent in chip design, and 42 percent in semiconductor equipment. The global semiconductor value chain is heavily dependent on technology produced and owned by American firms, giving the United States significant leverage in its technology rivalry with China.

A handful of American tech giants dominate AI innovation, closely tied to their commanding position in cloud computing. Each is rapidly expanding its AI leadership through acquisitions of smaller companies, investment in internal AI capabilities, and close partnerships with leading semiconductor firms. Nvidia is the world leader in producing advanced GPUs for AI. In May 2025, six U.S.-based firms at the forefront of the AI revolution (Amazon, Alphabet-Google, Meta-Facebook, Microsoft, Apple, and Nvidia) had a combined market capitalization of $15.4 trillion, representing 30 percent of U.S. stock market capitalization.

Under CPC leadership, China has demonstrated a strong capacity to pursue long-term goals and integrate the entire economic system—including finance, state enterprises, non-state enterprises, and research institutions—toward a common purpose. Guided by this philosophy, China achieved exceptionally rapid growth in national output. China’s GDP (in PPP$) has reached more than three-fifths of the G7. Its share of world manufacturing output (value-added) rose from 4 percent in 1970 to 31 percent in 2021. In that year, China’s manufacturing output was twice that of the United States and eighteen times greater than that of the UK, once the “workshop of the world” in the nineteenth century.

China has also advanced rapidly in global R&D investment. Between 2011 and 2022, its share of G2500 R&D spending rose from 4 to 18 percent. The U.S. share increased slightly, from 40 to 41 percent, while the EU’s share fell sharply from 23 to 18 percent, and Japan’s dropped from 15 to 9 percent. By 2022, China had 679 companies on the G2500 list, compared with 827 for the United States, 367 for the EU, 229 for Japan, and 22 for India.

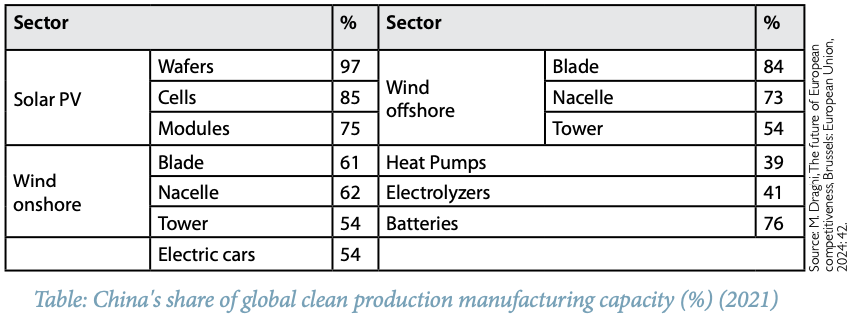

China has moved to the forefront of global electrification. The share of electricity in final energy consumption has risen to over 30 percent, compared with 22 percent in the United States and Europe. China has been described as “the world’s first electro-state.” It is leapfrogging the West in core technologies associated with electrification and the energy transition, including renewable energy, long-distance electricity transmission, high-speed rail, urban mass transport, electric vehicles, and batteries. Digital technology has penetrated daily life more thoroughly than in almost any other country. Across a wide range of clean technologies, China now accounts for more than two-thirds of global manufacturing capacity.

China’s ICT sector has made remarkable progress. By 2022, China’s share of G2500 ICT hardware R&D spending had reached 21 percent, compared with 11 percent for the EU and 7 percent for Japan. Its share of G2500 ICT software and services R&D spending rose to 15 percent, compared with 7 percent for the EU and 4 percent for Japan. America’s “technology war” is a vital part of its Cold War efforts against China. It is designed to cut China off from advanced semiconductors and from leading-edge semiconductor technologies, including IP, design, and equipment. By slowing China’s progress in the semiconductor value chain, the U.S.-led technology war seeks to restrict China’s advancement in AI.

In 2020, China’s consumption of semiconductors—including imports and domestic production—amounted to more than half of total global consumption. Less than 16 percent of China’s chip consumption was produced domestically, and about half of that output came from plants in China operated by global chip producers. The U.S.-initiated technology war left China with no choice but to intensify efforts to develop its own advanced semiconductor ecosystem.

This effort was coordinated by the Ministry of Industry and Information Technology (MIIT) and supported by the National Integrated Circuit Fund, which pools capital from the Ministry of Finance, local governments, and state-owned enterprises, including banks. The U.S. technology war provided a powerful incentive for China’s high-tech firms to work closely with indigenous chip makers and combine their efforts to achieve homegrown technological progress.

Huawei took the lead in China’s drive to enhance indigenous semiconductor capabilities. In 2023 and 2024, Huawei launched the Mate 60 and Mate 70 smartphones, with chips designed by Hisilicon and produced by SMIC. Huawei has become the systems integrator for a cluster of Chinese firms that strengthen indigenous capability across the semiconductor value chain, including EDA (Electronic Design Automation), chip equipment, memory chips, and foundry chip manufacturing. In 2025, Huawei began producing an artificial intelligence chip “cluster” (Cloud Matrix 384) that connects 384 Ascend 910C AI processors to deliver the computing power required to develop AI models and services.

In January 2025, DeepSeek unveiled its open-source AI large language model (R1), which can be downloaded for free. It was produced at a fraction of the cost of comparable models developed by American tech giants, yet it matches their performance. The low cost fueled DeepSeek’s rapid adoption. By spring 2025, DeepSeek was deployed by China’s main cloud service providers, local governments, automakers, hospitals, and SOEs. Tencent integrated DeepSeek directly into WeChat, which combines messaging, payments, healthcare, transport, shopping, and business services into a single seamless platform.

The success of DeepSeek’s AI large language model was a profound shock to the American AI tech giants. It managed to produce R1 despite the fierce U.S. technology war that restricted China’s access to the most powerful chips and advanced equipment. Far from stifling Chinese innovation, Washington’s technology war only stimulated it. As a January 2025 editorial of the Financial Times noted: “DeepSeek’s breakthrough upturns the assumptions that have underpinned U.S. tech valuations, of an unassailable supremacy in AI that would be extended by spending billions of dollars on chips and infrastructure. [It] raises questions over whether the technological ‘moat’ established by high-spending U.S. groups such as Meta, Google, OpenAI and Anthropic is as wide and impregnable as they had thought.”

Crossroads of Innovation

For two millennia before the eighteenth century, China led the world in harnessing water resources for agriculture, transport, and industrial use. During this long “hydraulic era,” China was the global leader in a wide array of technologies that reached Europe through trade along the Silk Road. These technologies laid the foundation for Europe’s technological progress after the Renaissance, culminating in the steam engine. They also provided the basis for the Military Revolution of 1500-1800, which underpinned British colonialism and played a vital role in the Industrial Revolution.

The “era of fossil fuels” began with the invention of the steam engine in the late eighteenth century. High-income economies dominated global innovation during this period, driving advances in thermal power stations, automobiles, aircraft, railways, and telecommunications. The era reached its height during the global business revolution after the 1980s, when oligopolistic competition along global value chains spurred explosive technical progress and innovation. The driving force behind industrial consolidation followed the logic of Karl Marx’s “law of concentration of capital” rather than Alfred Marshall’s “trees in the forest.” After 40 years of globalization, innovation is dominated by firms from high-income economies. Apart from China, firms from developing countries play only a negligible role in global innovation. China is the sole developing country building significant independent innovation capacity.

The era of fossil fuels is now drawing to a close. The world has entered a new era, based on electrification and information technology. The revolution in information technology underpins the energy transition. The commanding heights of information technology remain controlled by American firms; however, Chinese firms are catching up quickly. China’s long-term industrial policies have positioned it at the forefront of a wide array of industries contributing to a green and sustainable future: nuclear power, wind turbines, solar panels, HVDC long-distance electricity transmission lines, high-speed rail, urban mass transit, electric vehicles, batteries, telecoms equipment, and smartphones. America’s “technology war” is accelerating China’s progress in developing indigenous capacity to design and produce advanced semiconductors, including those that underpin the AI revolution. The new era of global innovation is taking a different shape from the one that preceded it. China is returning to the leading position in global innovation that it held before the fossil fuel era.